NO.PZ2024011002000023

问题如下:

Assume U.S. GAAP applies unless otherwise noted. An analyst gathered the following information about a company:

The bonds were

issued at par and can be converted into 300,000 common shares. All securities

were outstanding for the entire year. Diluted earnings per share for the

company are closest to:

选项:

A.$1.05 B.$1.26 C.$1.36解释:

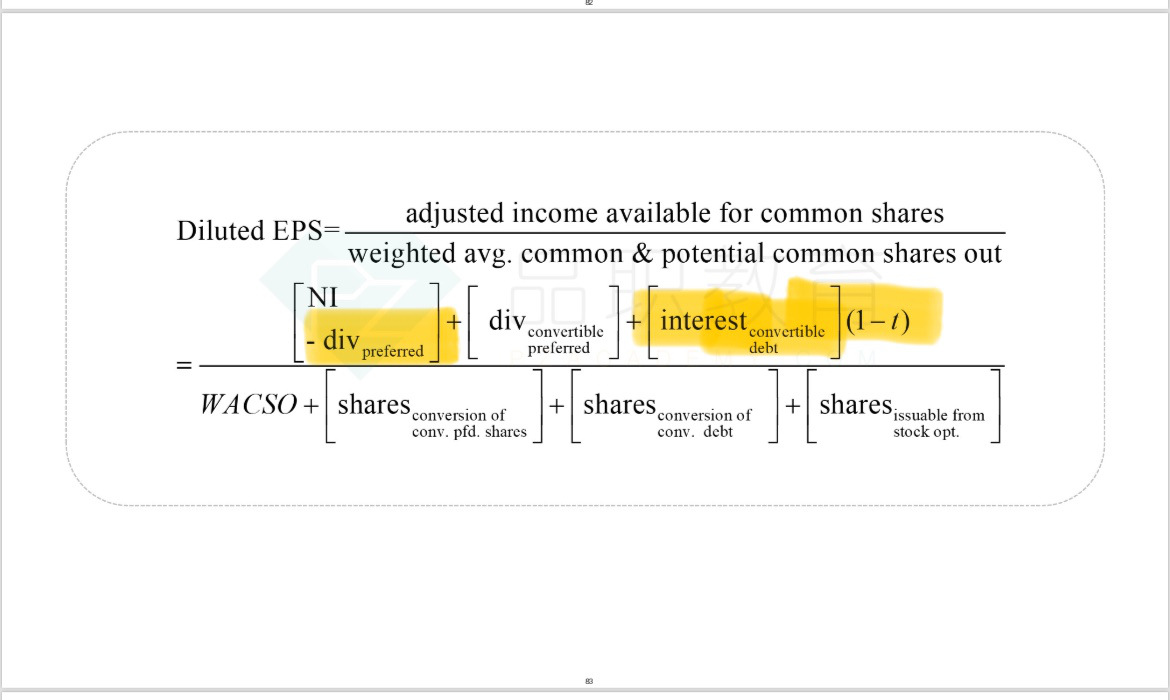

Preferred stock dividends of $140,000 (0.07* 2,000,000) should be deducted from net income to derive amount available for common shareholders: $1,360,000 = (1,500,000 - 140,000).

Basic EPS = $1,360,000/1,000,000 or $1.36 per share.

Diluted EPS would consider the convertible bonds if they were dilutive. Interest on the bonds would be $400,000 and the after-tax add back to net income would be $400,000 (0.7) or $280,000. Diluted EPS would be $1,640,000/1,300,000 shares assuming conversion = $1.26 per share.

可以解释一下1640000是怎么来的吗