NO.PZ2023091802000094

问题如下:

An analyst on the fixed-income derivatives desk at an investment bank is examining the method of determining the cheapest-to-deliver US Treasury bond when delivering into a short position in a Treasury bond futures contract. The analyst is focusing on the impact of the level and shape of the yield curve on determining which types of bonds are most likely the cheapest-to-deliver. Which of the following statements most likely to correctly describe the analyst’s findings?

选项:

A.An upward sloping yield curve favors low-coupon, short-maturity bonds.

B.An environment where bond yields are greater than 6% favors high-coupon, long-maturity bonds.

C.An environment where bond yields are less than 6% favors high-coupon, short-maturity bonds.

D.A downward sloping yield curve favors low-coupon, long-maturity bonds.

解释:

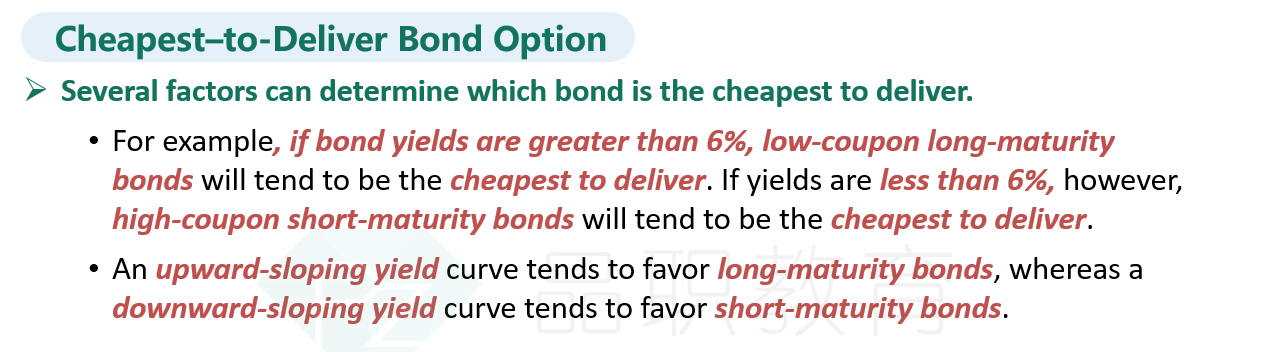

C is correct. Interest rate environments where bond yields are less

than 6% favor high-coupon, short-maturity bonds to be the cheapest to deliver

into a futures contract.

A is incorrect. An upward sloping yield curve favors long-maturity

bonds.

B is incorrect. An interest rate environment where bond yields are

greater than 6% favor low-coupon, long-maturity bonds.

D is incorrect. A downward sloping yield curve favors short-maturity

bonds.

老师好,这个我单纯靠死记记住了答案,但是想回去看看原理。请问一下这个知识点再讲义的哪里呀。我有印象讲过,但是找不到在哪里了。