NO.PZ2023091802000068

问题如下:

Current spot CHF/USD rate: 1.3680 (1.3680CHF = 1USD)

3-month USD interest rates: 1.05%

3-month Swiss interest rates: 0.35%

(Assume continuous compounding)

A currency trader notices that the 3-month future price is USD 0.7350. In order to arbitrage, the trader should investment:

选项:

A.Borrow CHF, buy USD spot, go long CHF futures

B.Borrow CHF, sell CHF spot, go short CHF futures

C.Borrow USD, buy CHF spot, go short CHF futures

D.Borrow USD, sell USD spot, go long CHF futures

解释:

Step 1. The spot is quoted in terms of Swiss Francs per USD,

theoretical future price of USD = 1.368 × e(0.35% – 1.05%) × 3/12 =

1.368 × 0.99825 = 1.36561 CHF

Step 2. 3-month future price is USD 0.7350 →

1/0.7350 = 1.3605 CHF

Step 3. 1.36561 CHF > 1.3605 CHF → USD

future contract is undervalued

Step 4. Arbitrage strategies: borrow USD (buy

CHF) spot, buy USD (short CHF) future.

老师好,这个汇率的题目总是有一点疑惑

他说1.368 CFH/USD. 那么CFH 就是base currency, USD is quoted currency.

to calculate future price

F=S[(1+RA)/(1+RB)]^T

Where RA is the interest rate of the quoted currency (1.05%) and RB is the interest rate of the base currency (0.35%)

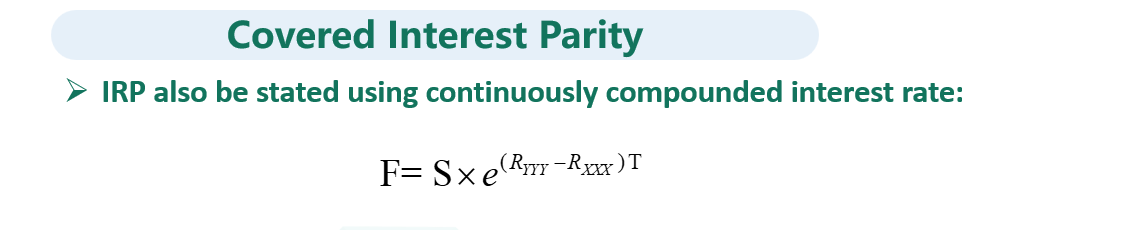

for continuous compounding interest rate

F不应该等于S*EXP[(RA-RB)*T]吗

为什么答案是F=1.368*EXP[(0.35%-1.05%)*0.25]