NO.PZ2023091802000199

问题如下:

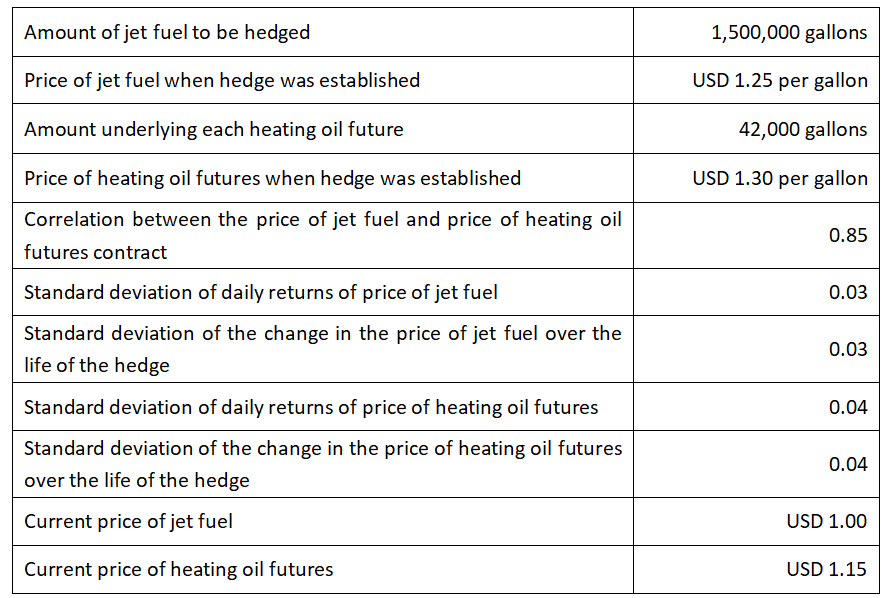

A risk manager at a transportation logistics company is evaluating an existing hedge. The hedge is designed to protect the company against changes in the price of jet fuel by using heating oil futures, and the manager is checking if the hedge employs the optimal number of contracts. The manager collects the following information about the relevant current prices and those prevailing when the hedge was established:

prevailing when the hedge was established:

prevailing when the hedge was established:

The manager notes that an optimal hedge was initially established and now wants to apply a tailing-the-hedge adjustment. After the adjustment is made, what is the correct hedge position for the company to have in place that now reflects both the current price of jet fuel and heating oil futures?

选项:

A.Long 20 contracts

Long 23 contracts

Short 20 contracts

Short 23 contracts

解释:

A is correct. The hedge ratio and optimal number of contracts at the inception of the hedge must be calculated first. number of contracts = correlation * (st dev spot/st dev futures)*(Value to be hedged/Value of futures contract) = 0.85 * (0.03/0.04) * (1,500,000 * 1.25/(42,000 * 1.3)) = 21.89 After 1 month the values have changed and the new optimal number of contracts is 0.85 * (0.03/0.04) * (1500000 * 1/(42,000 * 1.15)) = 19.80 So, 20 contracts need to be held to properly “tail the hedge”. B and D are incorrect. The initial number of contracts is incorrectly calculated as 0.85 * (0.03/0.04) * (1,500,000/42,000) = 22.8, so 23 contracts need to be sold to properly “tail the hedge”.

C is incorrect. Here the calculation is correct, but the contracts should be long and not short.

解析能否分为每个步骤来