NO.PZ2023052301000072

问题如下:

Which of the following benefits of securitization is most likely to be important for investors?

选项:

A.Increased efficiency

Reduced liquidity risk

The ability to tailor interest rate and credit risk exposures

解释:

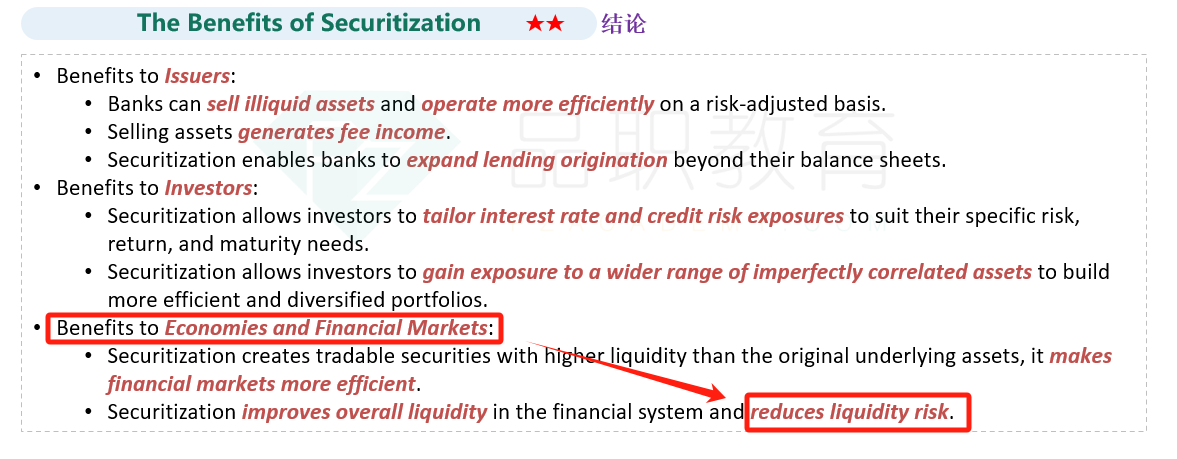

The correct answer is C. Securitization provides a direct conduit between borrowers and investors. It also allows investors to tailor interest rate and credit risk exposures to suit their specific risk, return, and maturity needs.

A is incorrect because securitization creates efficiency for issuers and financial markets more directly than for investors. Securitization allows issuers to sell illiquid assets and operate more efficiently on a risk-adjusted basis. Moreover, because securitization creates tradable securities with higher liquidity than the original underlying assets, it makes financial markets more efficient.

B is incorrect because securitization improves overall liquidity in the financial system and reduces liquidity risk, which benefits participants in financial markets.

B可以是issuer 的好处吗