NO.PZ202208260100000802

问题如下:

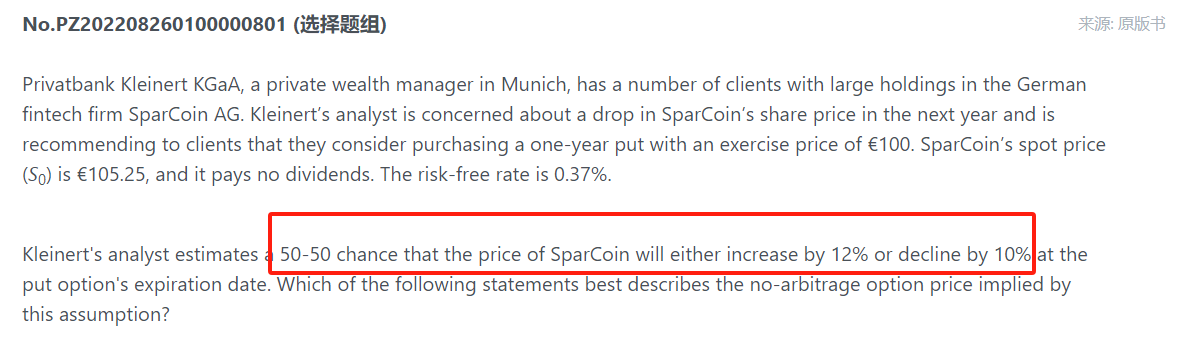

Privatbank Kleinert KGaA, a private wealth manager in Munich, has a number of clients with large holdings in the German fintech firm SparCoin AG. Kleinert’s analyst is concerned about a drop in SparCoin’s share price in the next year and is recommending to clients that they consider purchasing a one-year put with an exercise price of €100. SparCoin’s spot price (S0) is €105.25, and it pays no dividends. The risk-free rate is 0.37%.

If Kleinert's clients observe that the one-year put option with a €100 exercise price is trading at €2.50, which of the following statements best describes how Kleinert's clients could take advantage of this to earn a risk-free return greater than 0.37% over the year.

选项:

A.Kleinert should purchase the put option and also purchase approximately 0.23 shares per option to match the hedge ratio.

B.Kleinert should purchase the put option and purchase 50% of the underlying shares given the 50-50 chance the stock will fall and the put option exercised.

C.Kleinert should purchase the put option and purchase 47% of the underlying shares to match the risk-neutral probability of put exercise.

解释:

Solution

A is correct.

If the put option can be purchased for less than the no-arbitrage price, then a potential arbitrage opportunity is available. In this case, Kleinert's clients should purchase the underpriced put option and buy h* units of SparCoin's stock. The hedge ratio, h*, is calculated as:

Note that the negative hedge ratio implies that both the put option and underlying are purchased or sold to create a hedge. This initial purchase of the put option and stock will cost:

€2.50 + 0.2276 × €105.25 = €26.45.Should the stock price decrease, the value of this portfolio will be:

The strategy generates a risk-free return of (€26.83 – €26.45)/€26.45 = 1.44%, which is greater than the 0.37% return on other available risk-free investments.

中文解析

由上面一问我们可以知道,该看跌期权的无套利价格是2.78,现在市场上看跌期权的价格是2.50。根据低买高卖的套利原理,我们应该买入该看跌期权,对应的如果构成hedged

portfolio,需要long stock。然后根据公式计算h为0.2276份。

此时,一份的put和0.2276份stock可以构成一个hedged portfolio.

该组合初始价值为:€2.50 + 0.2276 × €105.25 = €26.45

计算当股价下跌的时候,组合新的价值V1为€26.83.

此时可以计算得到return为1.44%,是大于题干所说的高于0.37%的。

当然,就选出答案来说,只需计算出h即可。

题目解析里面117.88和94.73是怎么算出来的,我在题干没找到相关信息