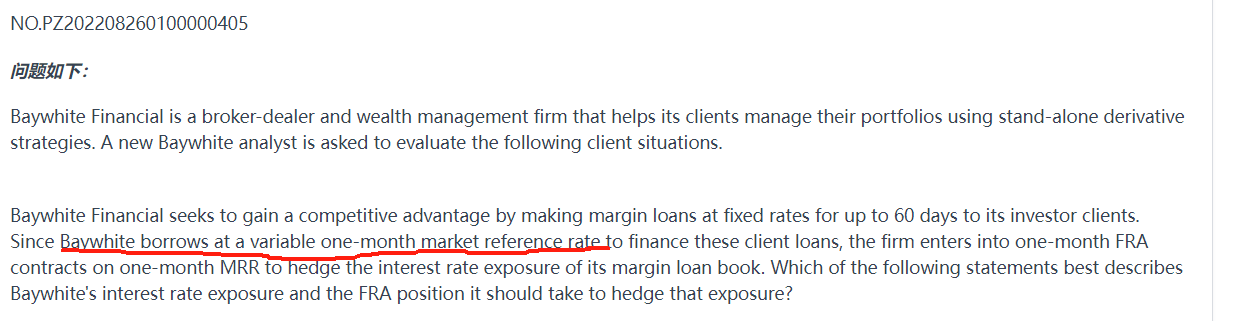

NO.PZ202208260100000405

问题如下:

Baywhite Financial is a broker-dealer and wealth management firm that helps its clients manage their portfolios using stand-alone derivative strategies. A new Baywhite analyst is asked to evaluate the following client situations.

Baywhite Financial seeks to gain a competitive advantage by making margin loans at fixed rates for up to 60 days to its investor clients. Since Baywhite borrows at a variable one-month market reference rate to finance these client loans, the firm enters into one-month FRA contracts on one-month MRR to hedge the interest rate exposure of its margin loan book. Which of the following statements best describes Baywhite's interest rate exposure and the FRA position it should take to hedge that exposure?

选项:

A.Baywhite faces exposure to a rise in one-month MRR over the next 30 days, so it should enter into the FRA as a fixed-rate payer in order to benefit from a rise in one-month MRR above the FRA rate and offset its higher borrowing cost.

B.Baywhite faces exposure to a rise in one-month MRR over the next 30 days, so it should enter into the FRA as a fixed-rate receiver in order to benefit from a rise in one-month MRR above the FRA rate and offset its higher borrowing cost.

C.Baywhite faces exposure to a decline in one-month MRR over the next 30 days, so it should enter into the FRA as a fixed-rate receiver in order to benefit from a rise in one-month MRR above the FRA rate and offset its higher borrowing cost.

解释:

Solution

A is correct.

As Baywhite faces exposure to a rise in one-month MRR over the next 30 days, it should enter into the FRA as a fixed-rate payer in order to benefit from a rise in one-month MRR above the FRA rate and offset its higher borrowing cost. Both B and C are incorrect, as the fixed-rate receiver in an FRA does not benefit but rather must make a higher payment upon settlement if MRR rises.

中文解析:

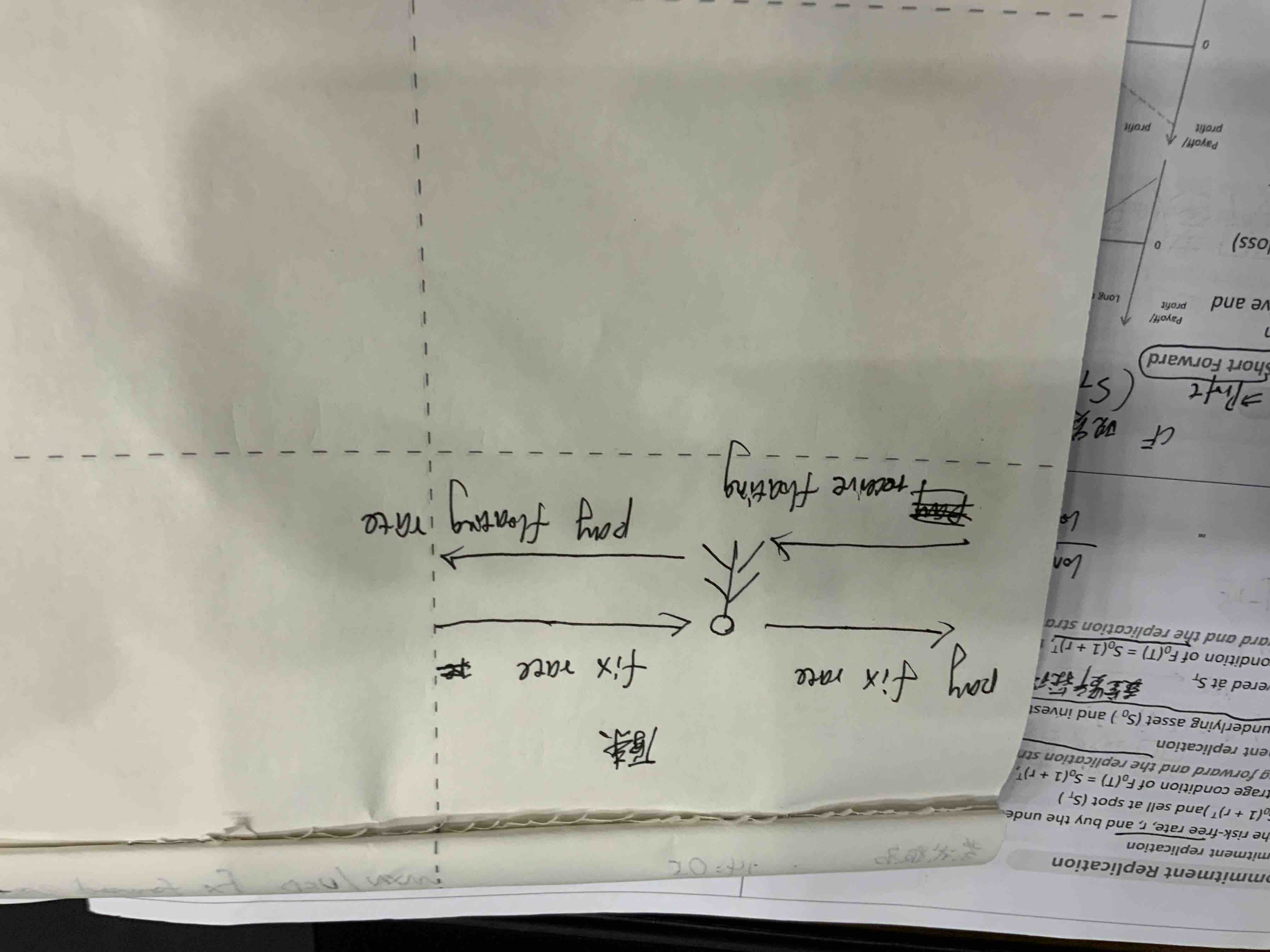

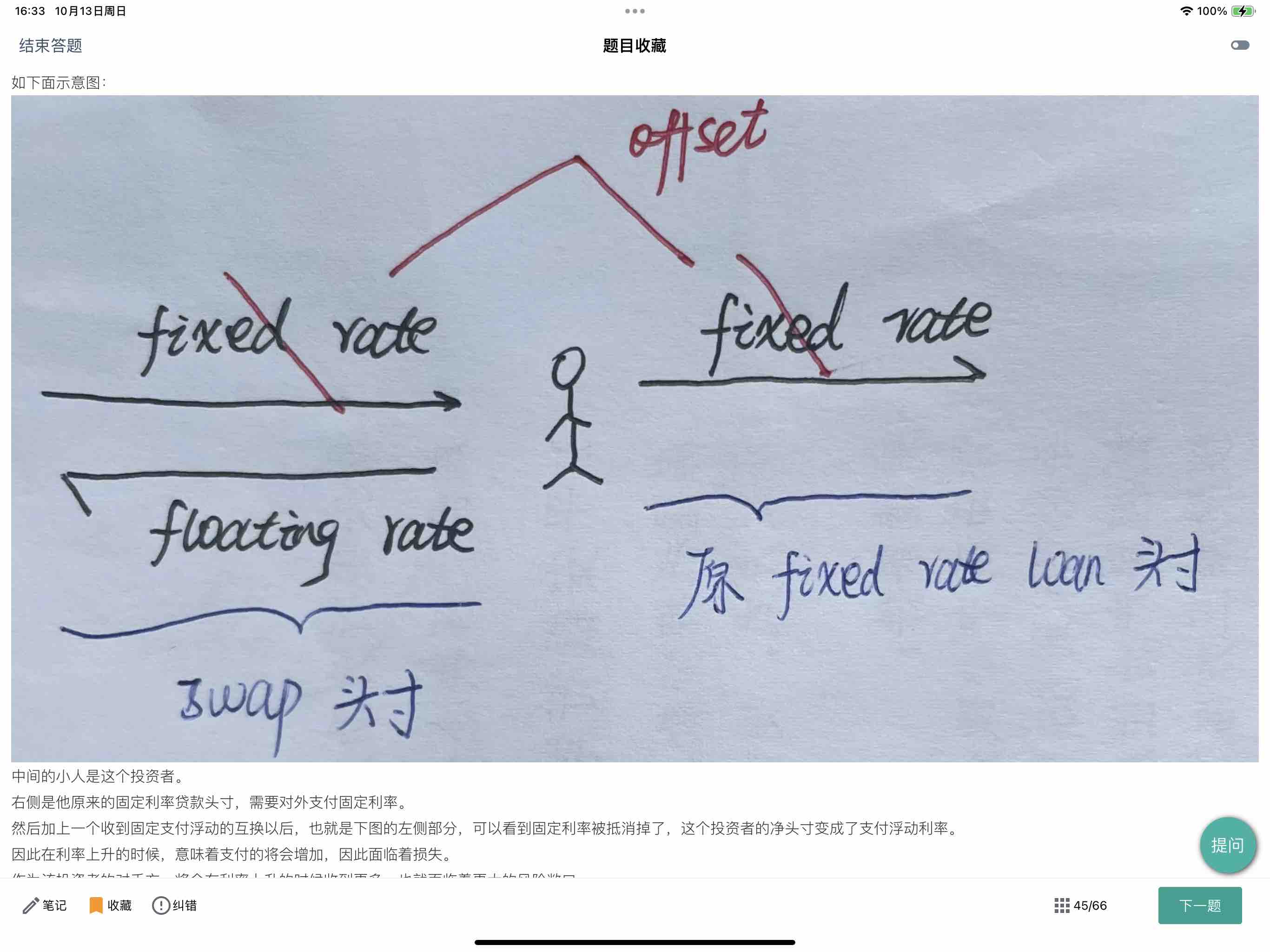

Baywhite有两个头寸:

一是他按照固定利率把钱借出去,借给了他的投资者。

二是他按照浮动利率向贷款,此时是把钱借进来。

即Baywhite收到投资者给他的固定利率,同时支付贷款发生的浮动利率。因此Baywhite面临着利率上涨的风险。

那么担心利率上涨,Baywhite应该long

FRA,也就是付固定,收浮动。

综上分析可知,本题选A。

我又做了一题,感觉跟这个可以对比一下。品职出题,解答里面画了一个图我觉得我看懂了,然后我依葫芦画瓢也画了一个,右边是原来的,左边是他为了对冲原来的,所以就pay- fix,receive floating,助教看看对不不对,不对的话帮我纠正一下思路,再次感谢。