NO.PZ2024021801000069

问题如下:

Which of the following statements about ESG performance attribution is most accurate?选项:

A.ESG engagement value is easy to measure B.The performance impact that comes from excluding a specific sector is easy to measure C.Continued ESG integration improves the ability to disaggregate a particular ESG driver from the broader investment decision解释:

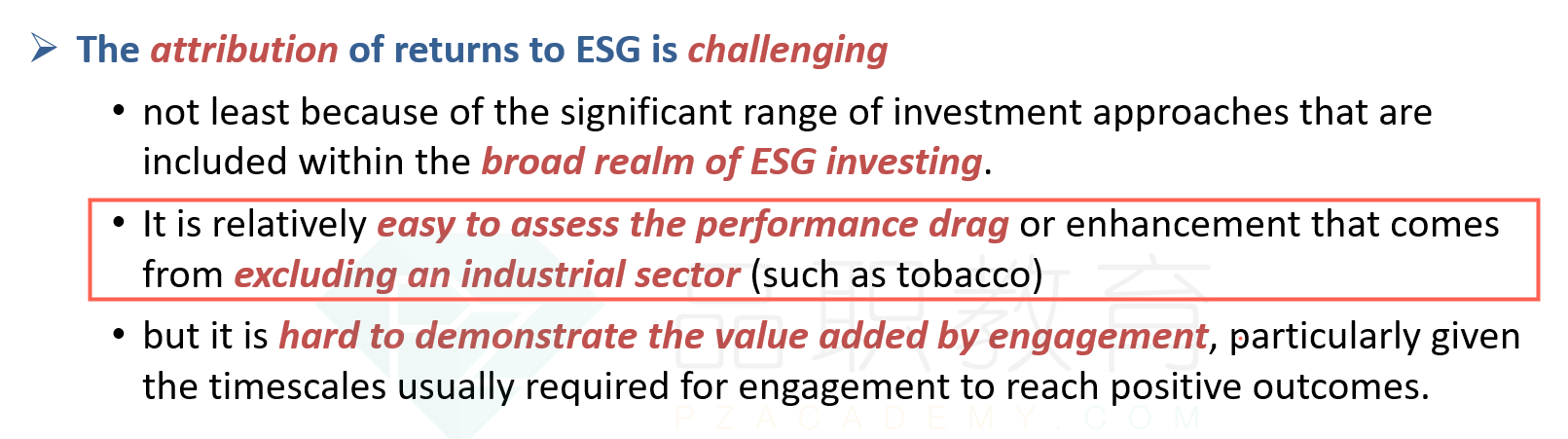

A is incorrect because it is hard to demonstrate the value

added by a programme of engagement, particularly given the timescales usually

required for engagement programmes to reach positive outcomes.

B is correct because it is relatively easy to assess the

performance drag or enhancement that comes from excluding an industrial sector

(such as tobacco).

C is incorrect because the more fully integrated ESG becomes

into the investment process, the harder it becomes to disaggregate a particular

ESG driver from the broader investment decision.

这道题的考点是否是ESG业绩归因?是否有ESG业绩归因的系统性知识点,具体在哪里?