NO.PZ2024021802000023

问题如下:

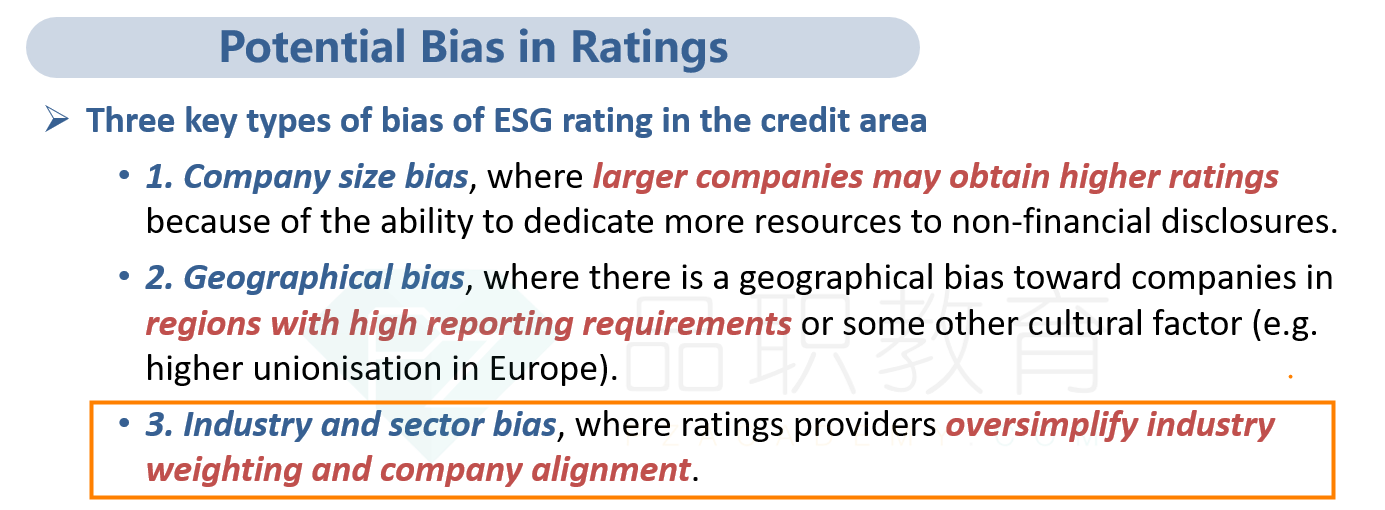

ESG rating providers oversimplifying industry weighting and company alignment best describes:选项:

A.geographical bias. B.company size bias. C.industry and sector bias.解释:

A. Incorrect because it describes industry and sector bias, not geographical bias, where a geographical bias exists toward companies in regions with high reporting requirements or some other cultural factor (e.g., higher unionization levels in Europe).

B. Incorrect because it describes industry and sector bias, not company size bias, where larger companies might obtain higher ratings because of the ability to dedicate more resources to nonfinancial disclosures.

C. Correct because one key type of bias typically encountered is industry and sector bias, where rating providers oversimplify industry weighting and company alignment.

我怎么记得老师上课的时候说评级机构一般会有一个惯性,可能会跟公司的size有关,越大的公司越容易有强的ESG表现,所以更容易给高分。为什么B不对呢?