NO.PZ2023091802000105

问题如下:

Stock UGT is trading at USD 100. A 1-year European call option on UGT with a strike price of USD 80 is trading at USD 30. No dividends are being paid in the following year. What should be the lower bound for an American put option on UGT with a strike price of USD 80, in order to not have arbitrage opportunities? Assume a continuously-compounded risk-free rate of 4% per year.

选项:

A.

6.1

B.

7.7

C.

5.7

D.

6.9

解释:

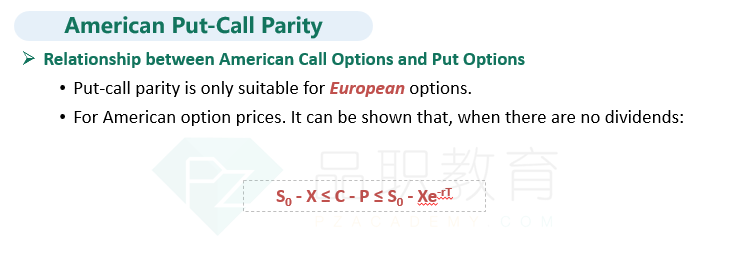

The European call option is the same as an American call option,

since there are no dividends during the life of the options. American call and

put prices satisfy the inequality.

S – K ≤ C – P ≤ S – Ke – rt, thus Ke

– rt – S + C ≤ P ≤ K – S + C,

therefore:6.86 ≤ P ≤ 10.

6.9 falls between 6.86 and 10.

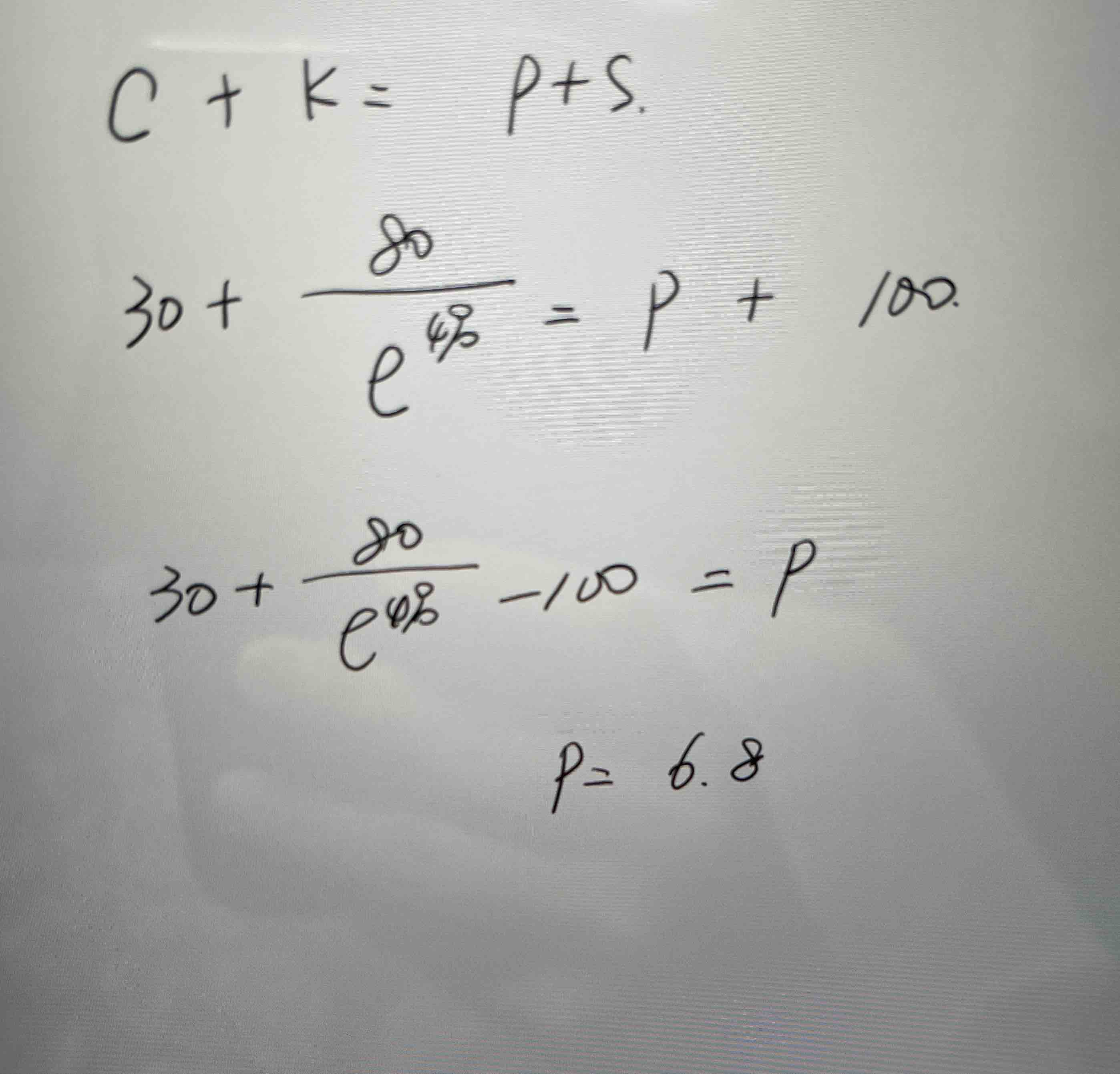

用“no divided”,没有分红的美式期权不会提前行权,就等同于欧式期权这个概念用欧式的C+K=P+S行不行呢?