NO.PZ2023100703000111

问题如下:

Which of the following regarding equity option volatility is true?选项:

A.There is higher implied price volatility for away-from-the-money equity options.

B.“Crashophobia” suggests actual equity volatility increases when stock prices decline.

C.Compared to the lognormal distribution, traders believe the probability of large down movements in price is similar to large up movements.

D.Increasing leverage at lower equity prices suggests increasing volatility.

解释:

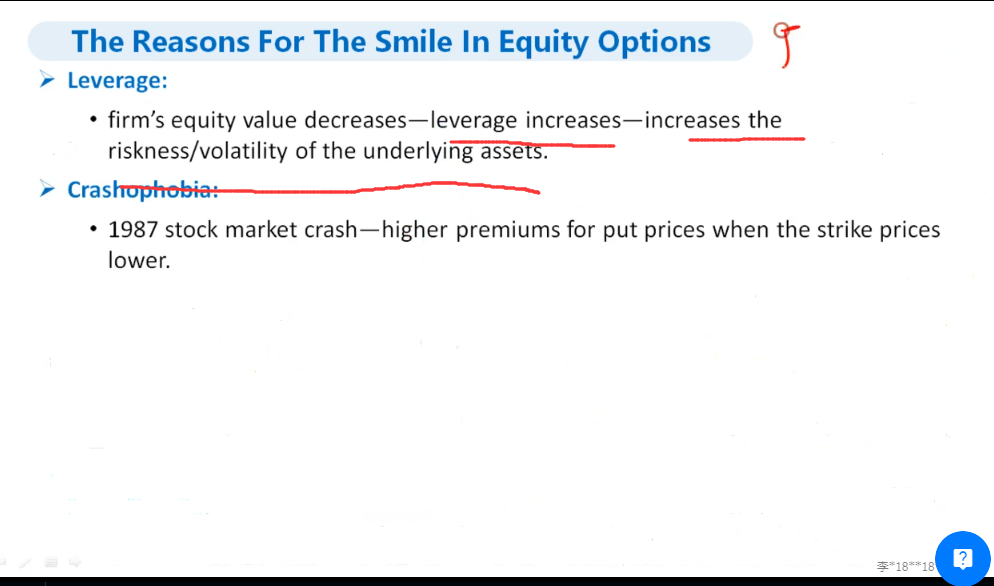

There is higher implied price volatility for low strike price equity options. “Crashophobia” is based on the idea that large price declines are more likely than assumed in Black-Scholes-Merton prices, not that volatility increases when prices decline. Compared to the lognormal distribution, traders believe the probability of large down movements in price is higher than large up movements. Increasing leverage at lower equity prices suggests increasing volatility.请解释一下D是什么意思