NO.PZ202206210100000303

问题如下:

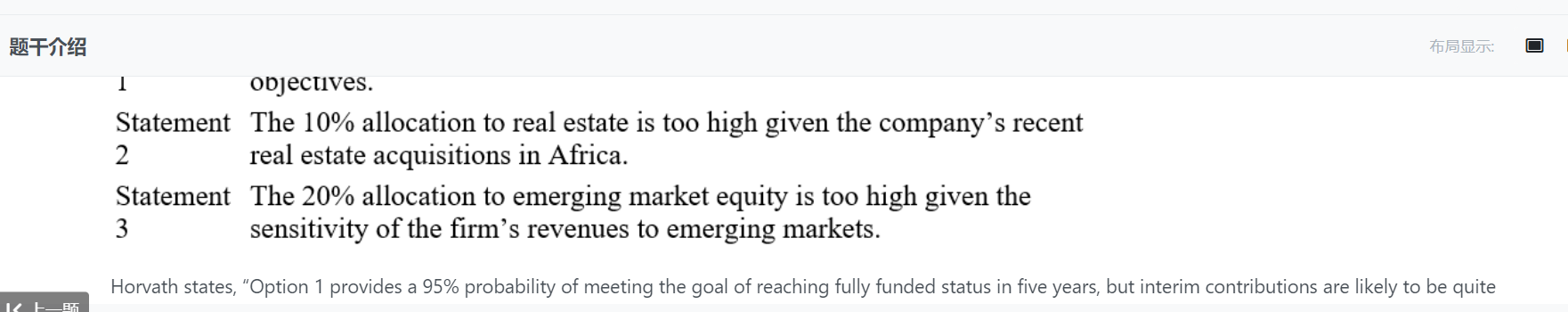

Which of Radell’s statements regarding asset allocation Option 1 is most appropriate?

选项:

A.Statement 1 B.Statement 2 C.Statement 3解释:

C is correct. Statement 3 is most appropriate. The 20% allocation to emerging market equity is too high given the company’s goals and objectives and the sensitivity of revenues to the African economy. A weak emerging market economic environment is likely to stress the pension fund’s investment in emerging market equity and its revenue from its emerging market business simultaneously. Thus, the high volatility of emerging market equity, its limited diversification potential relative to global equity, and the sensitivity of the firm’s revenues to emerging market economies make a large, over-weighted allocation to the asset class inconsistent with the firm’s objective of minimizing fluctuations in year-to-year required contributions.

A

is incorrect. The Sharpe ratios for the current allocation, Option 1, and

Option 2 are 0.17, 0.19, and 0.175, respectively, with Option 1 having the

highest Sharpe ratio. The Sharpe ratio, while providing a means to rank choices

on the basis of return per unit of volatility, does not capture other

characteristics that are important to Sabonete, such as funded ratio, time

horizon, and predictability of contributions.

B

is incorrect. Sabonete’s land holdings outside of the pension fund are not

considered a part of the extended balance sheet for the SPP and should not

affect its asset allocation decisions.

Sabonete’s recent

acquisition of land in Africa are outside of the pension fund and, therefore,

should not be considered a part of the extended balance sheet for the SPP and

should not affect its asset allocation decisions.

3个statement对应到题干中的哪些内容?比如statement 1 里的objecitves,未在题干中找到相应内容,无法判断对错