NO.PZ2018122701000088

问题如下:

An empirical distribution of equity price derived from the price of options of such stock based on BSM that exhibits a fatter right tail than that of a lognormal distribution would indicate:

选项:

A.

Equal implied volatilities across low and high strike prices.

B.

Greater implied volatilities for low strike prices.

C.

Greater implied volatilities for high strike prices.

D.

Higher implied volatilities for mid-range strike prices.

解释:

C is correct.

考点Volatility Smile

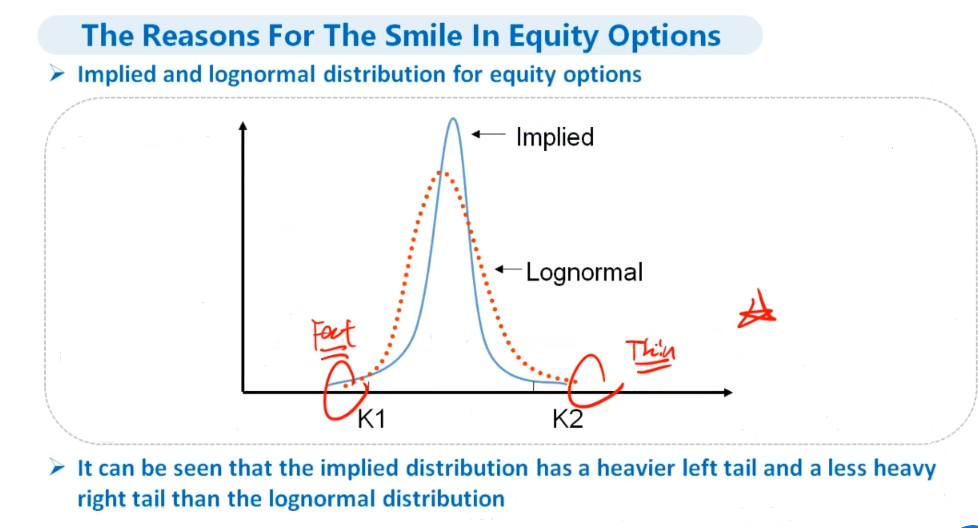

解析An empirical distribution with a fat right tail generates a higher implied volatility for higher strike prices due to the increased probability of observing high underlying asset prices.

老师 可以解析一下这个 左高右低的问题吗 ? 我有点搞混了 , 为啥 greater volatility 会 high Strike Price ?