NO.PZ2023100703000059

问题如下:

A portfolio manager owns a portfolio of options on a non-dividend paying stock RTX. The portfolio is made up of 10,000 deep in-the-money call options on RTX and 50,000 deep out-of-the money call options on RTX. The portfolio also contains 20,000 forward contracts on RTX. RTX is trading at USD 100. If the volatility of RTX is 30% per-year, which of the following amounts would be closest to the 1-day VaR of the portfolio at the 95 percent confidence level, assuming 252 trading days in a year?选项:

A.USD 932

B.USD 93,263

C.USD 111,122

D.USD 131,892

解释:

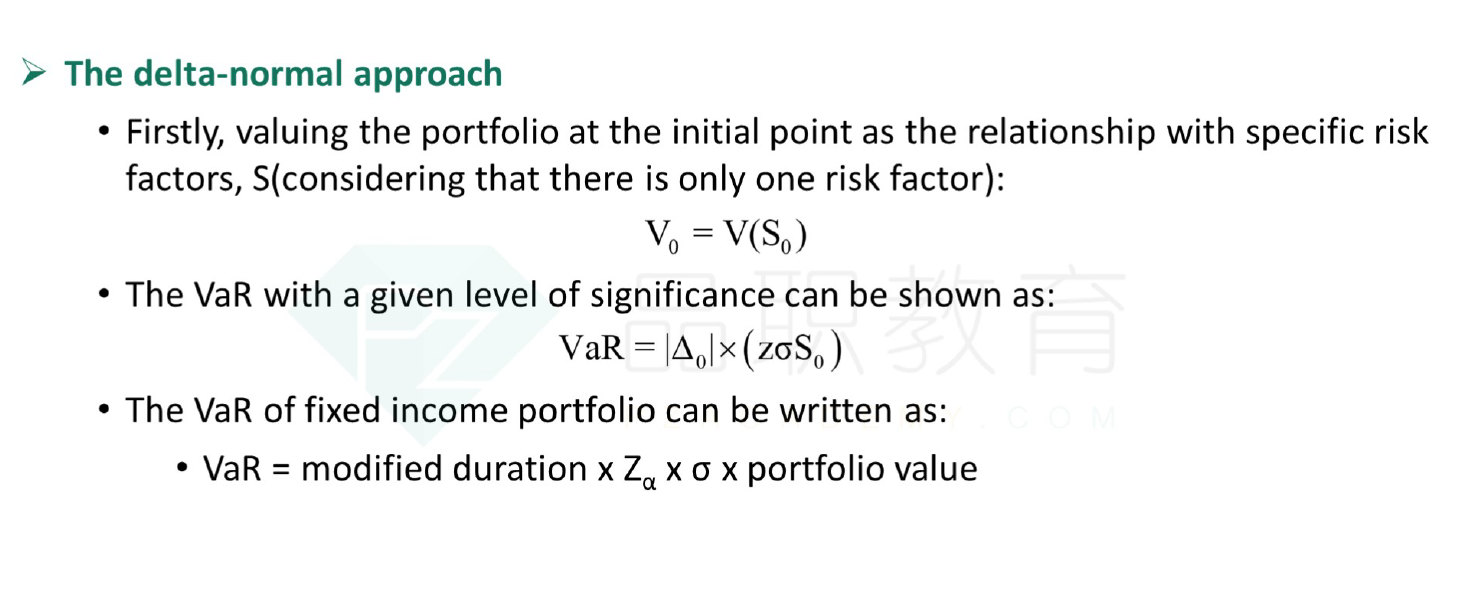

We need to map the portfolio to a position in the underlying stock RTX. A deep in-the-money call has a delta of approximately 1, a deep out-of-the-money call has delta of approximately 0 and forwards have a delta of 1. The net portfolio has a delta of about 30,000 and is approximately gamma neutral. The 1-day VaR estimate at 95 percent confidence level is computed as follows:

这个公式对应课件哪一条