NO.PZ2023040701000028

问题如下:

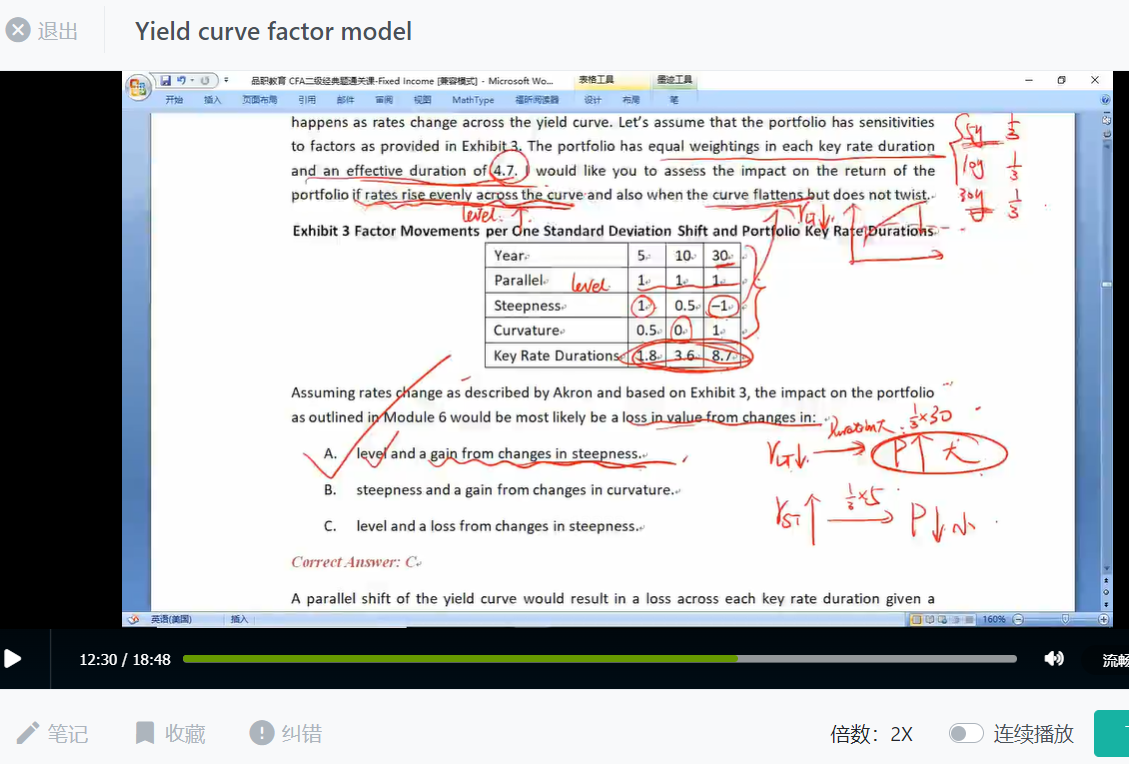

Module 6: Consider a portfolio of zero-coupon bonds that mature at different times in the future. Changes in interest rates are not always parallel across maturities, so let’s analyze what happens as rates change across the yield curve. Let’s assume that the portfolio has sensitivities to factors as provided in Exhibit 3. The portfolio has equal weightings in each key rate duration and an effective duration of 4.7. I would like you to assess the impact on the return of the portfolio if rates rise evenly across the curve and also when the curve flattens but does not twist.

Exhibit 3 Factor Movements per One Standard Deviation Shift and Portfolio Key Rate Durations

Assuming rates change as described by Akron and based on Exhibit 3, the impact on the portfolio as outlined in Module 6 would be most likely be a loss in value from changes in:

选项:

A.

level and a gain from changes in steepness.

B.

steepness and a gain from changes in curvature.

C.

level and a loss from changes in steepness.

解释:

Correct Answer: C

A parallel shift of the yield curve would result in a loss across each key rate duration given a sensitivity of 1. For example, a 100 basis point (bp) parallel shift would generate an approximately 4.7% loss in value. A flattening of the yield curve in the long end would result in a loss given a sensitivity of –1. For example, a 100 bp decline in the 30-yearkey rate duration would result in a loss of approximately 2.9% (–100 × –0.01 ×–8.7 × 0.333). There is no impact from curvature, since the curve did not “twist”.

老师可以帮忙详细计算下吗