NO.PZ2024021801000073

问题如下:

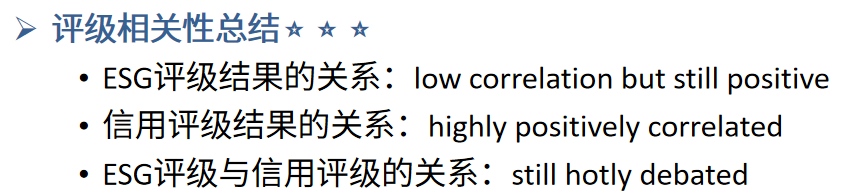

Which of the following statements is most accurate?选项:

A.ESG ratings have a weak correlation to those of other rating agencies; credit ratings have a weak correlation to those of other rating agencies

B.ESG ratings have a weak correlation to those of other rating agencies; credit ratings have a strong correlation to those of other rating agencies

C.ESG ratings have a strong correlation to those of other rating agencies; credit ratings have a strong correlation to those of other rating agencies

解释:

A. Incorrect because credit ratings have strong correlation with each other.

B. Correct because ESG ratings do not correlate like bond credit ratings, nor do agencies use the same methods of scoring. Further, currently there is limited consensus amongst investors on ESG ratings. However, this is somewhat different to CRAs, which typically have highly correlated credit ratings.

C. Incorrect because ESG ratings do not have a strong correlation to each other.

没理解没看懂,求解啊