NO.PZ2023090506000025

问题如下:

The annual report of company ABC includes the following statements:

Statement 1: “When assessing investment projects, ABC uses inflation-adjusted cash flows and discounts them with real rates.”

Statement 2: “ABC’s management does not alter the required rate of return for capital projects based on internal or external funding sources.”

Statement 3: “ABC’s management compensation is linked to exceeding a target EPS growth rate.” Which of these policies does not align with best practices in capital allocation?

选项:

A.Statement 1

Statement 2

Statement 3

解释:

C is correct. Positive-NPV investment projects can reduce, rather than increase, EPS in the near term, even though they increase shareholder value. Management compensation should incorporate a longer-term perspective and a measure that better considers required rates of return, such as ROIC.

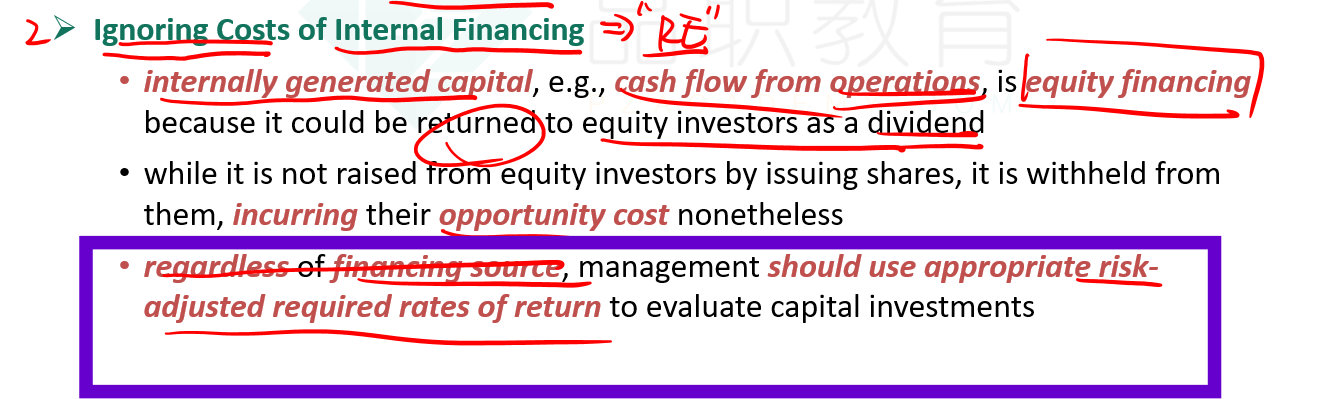

B is incorrect because internally generated capital, such as cash flow from operations, is equity financing and it could be returned to equity investors as a dividend. Regardless of the financing source, management should use appropriate risk-adjusted required rates of return to evaluate capital investments.

A is incorrect because companies may perform analysis in either nominal or real terms, but the approach to cash flows and the discount rate should be consistent. That is, nominal cash flows should be discounted at a nominal discount rate, and real (inflation-adjusted) cash flows should be discounted at a real rate.

我感觉选项B也不对,为什么不选,能帮忙解释下么?