NO.PZ2021061002000052

问题如下:

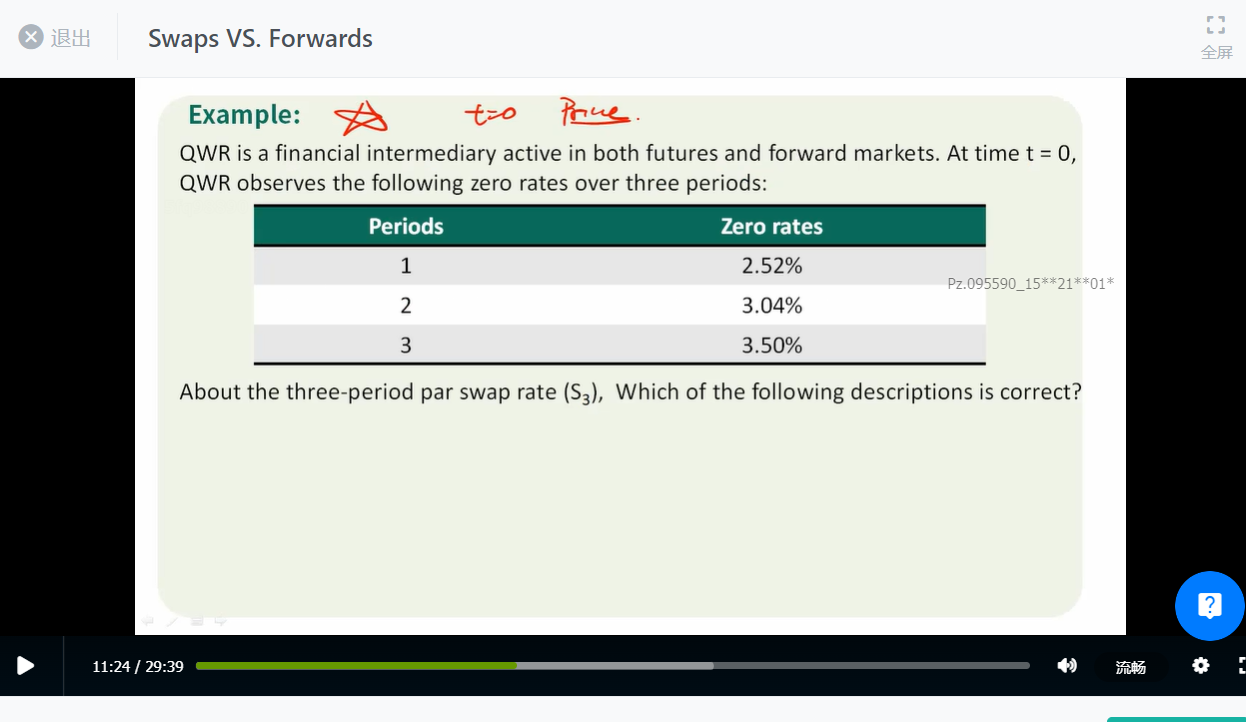

QWR is a financial intermediary active in

both futures and forward markets. At time t = 0, QWR observes the following

zero rates over three periods:

About the three-period par swap rate (S3), Which of the following descriptions is correct?

选项:

A.Because the swap rate represents the fixed

rate at which the present value of fixed and future cash flows equal one

another, we can first use zero rates to solve for the implied forward rate per

period, then discount each implied forward rate back to the present using zero

rates, and solve for s3 to get 3.46%.

Because the swap rate represents the fixed

rate at which the present value of fixed and future cash flows equal one

another, we can use zero rates to discount each zero rate back to the present,

and solve for s3 to get 3.02%.

Because the swap rate represents the fixed

rate at which the present value of fixed and future cash flows equal one

another, we can first use zero rates to solve for the implied forward rate per

period, then discount each zero rate back to the present using implied forward

rates, and solve for s3 to get 3.99%

解释:

中文解析

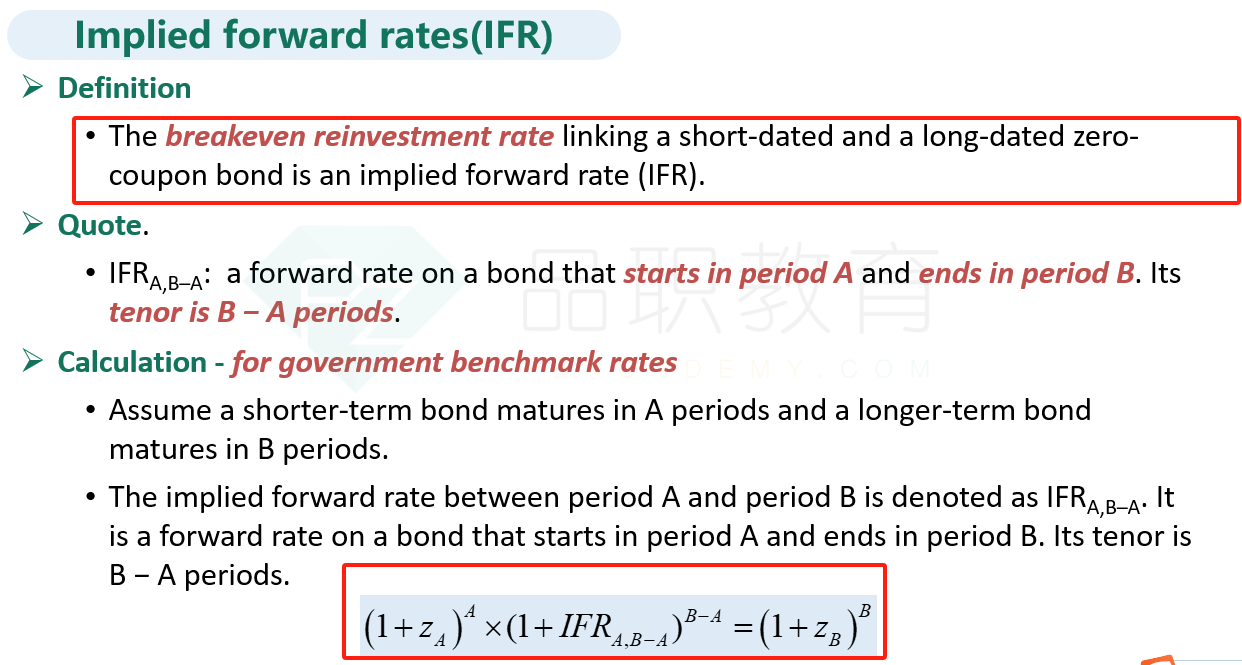

本题考察的实际是“脱靴(bootstrapping)”的过程。

具体计算如下:

先根据下面的公式计算出:

IFR0,1 = 2.52%, IFR1,1 = 3.56%, and IFR2,1 = 4.43%

然后再按照下面的公式计算S3:

最终得到S3 =3.46%,选A。

如题,该题中涉及到的几个利率分别怎么区别,定义有什么不一样?S3不是spot rate 3吗? S3是什么?