NO.PZ2018062007000072

问题如下:

Which of the following combinations replicates a long derivative position?

选项:

A.

A short derivative and a long asset

B.

A long asset and a short risk- free bond

C.

A short derivative and a short risk- free bond

解释:

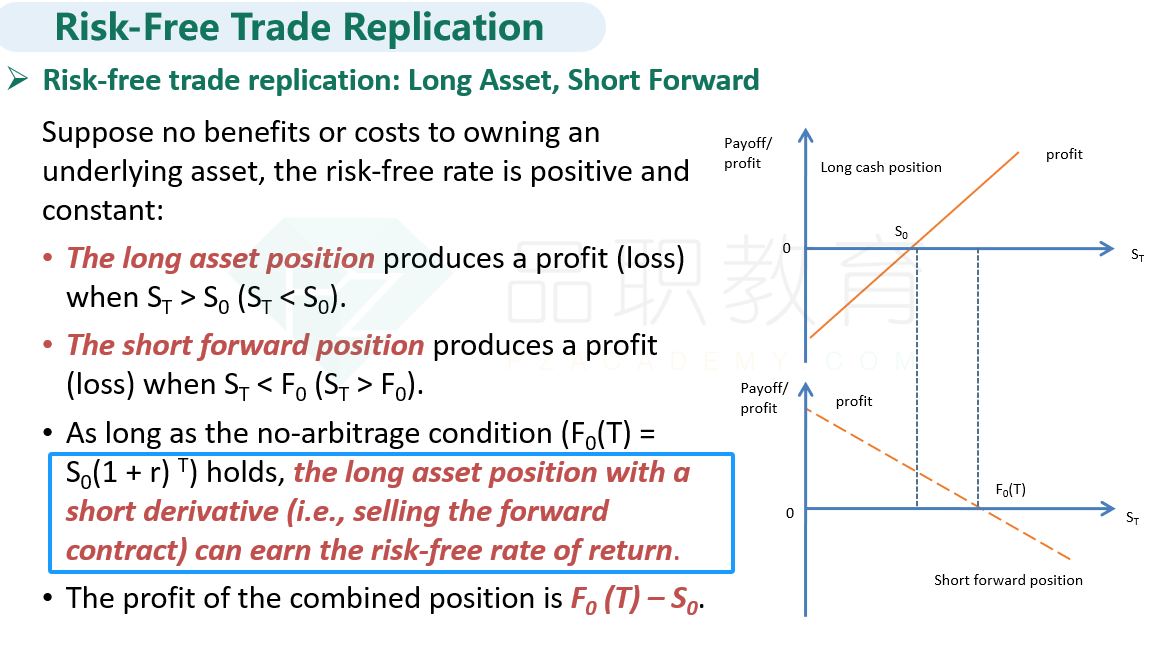

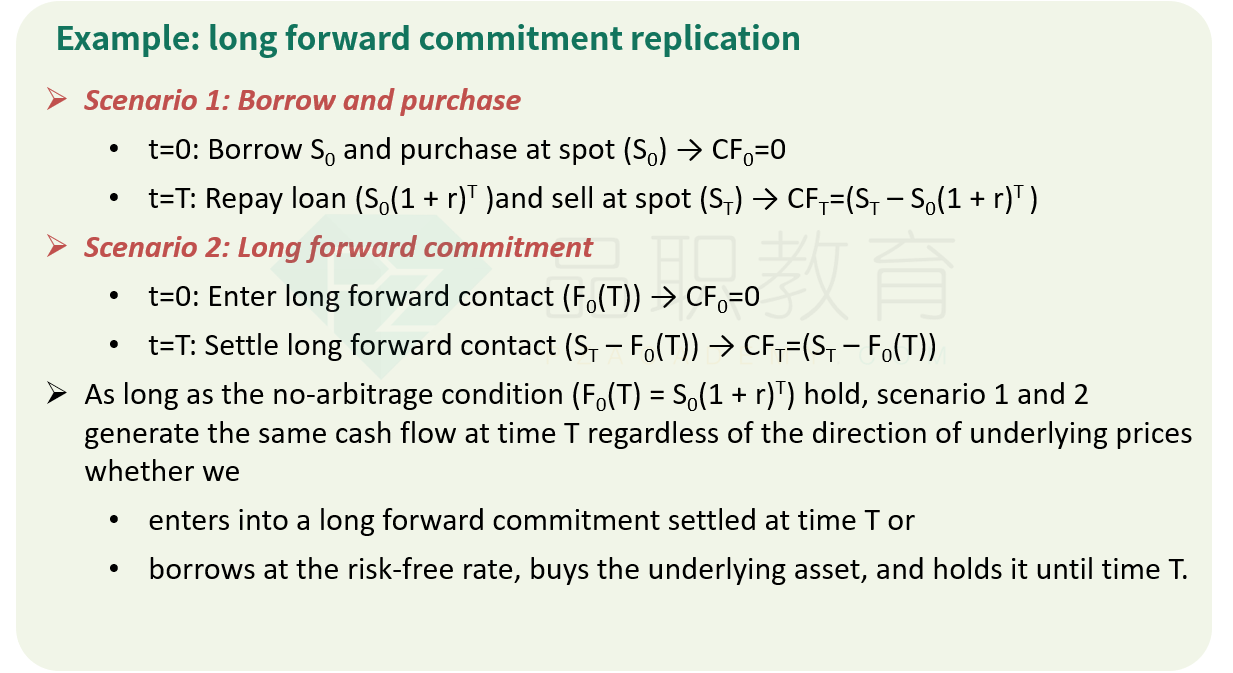

B is correct. A long asset and a short risk- free asset (meaning to borrow at the risk- free rate) can be combined to produce a long derivative position.

A is incorrect because a short derivative and a long asset combine to produce a position equivalent to a long risk- free bond, not a long derivative.

C is incorrect because a short derivative and a short risk- free bond combine to produce a position equivalent to a short asset, not a long derivative.

中文解析:

本题考察的是合成一个long derivative头寸,如下图红线框出来的部分,选B 。

答案解析中出现的三个公式在基础班讲义的哪一页?李老师没讲啊?请问这三个公式分别如何理解,请老师详细解释。或者请李老师补充此部分的讲解视频!