Mark Crawley is an analyst at a London-based private equity firm and is reviewing the firm’s file on Thames Air Plc (Thames), a company it provides financing for. Thames uses International Financial Reporting Standards (IFRS) in the preparation of its financial statements. Thames is a relatively new airline based in the United Kingdom specializing in flights and vacation packages to Mediterranean locations, primarily Spain. Thames sells most of its flights and vacation packages to British residents in Britis……以下略

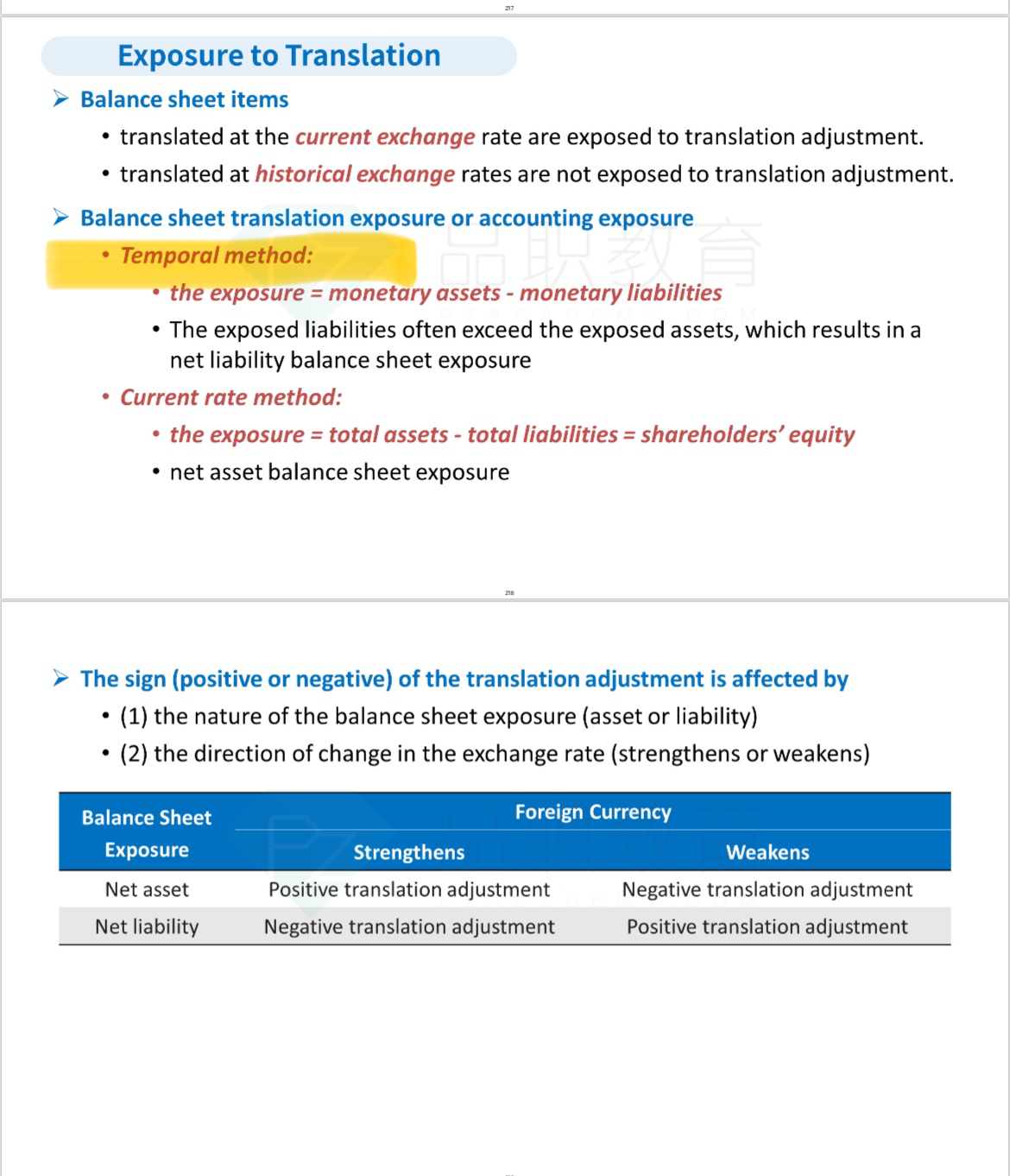

有一小问是:The most likely effect of the change in the exchange rate between the EUR and GBP arising from Thames’s investment in Tagus in 2015 will be a translation:

A. loss reported in net income.

B. gain reported in net income.

C. adjustment reported in other comprehensive income.

A Correct. Thames is using the temporal method for its translation of Tagus, and the initial exposure is a net liability exposure (monetary liabilities of EUR13,500 exceed the monetary assets of EUR4,000). The EUR strengthened against the GBP during the six-month period (from GBP0.7200/EUR to GBP0.7500/EUR). The net effect of having a net liability position in a strengthening currency will be a translation loss for Thames, which, under the temporal method, is reported in net income.

没有读懂问题,我以为它说的Thames对Tagus的股权投资,在2015年会因为汇率变化而导致什么样的外汇结算损益?但答案开始说net exposure的事情,不是很明白和这道题问的有什么联系,我的理解哪里有问题?谢谢。