NO.PZ202212300100014002

问题如下:

Based on Exhibit 2, Vasileva should reject the null hypothesis that:

选项:

A.the slope is less than or equal to 0.15. B.the intercept is less than or equal to zero. C.crude oil returns do not explain Amtex share returns.解释:

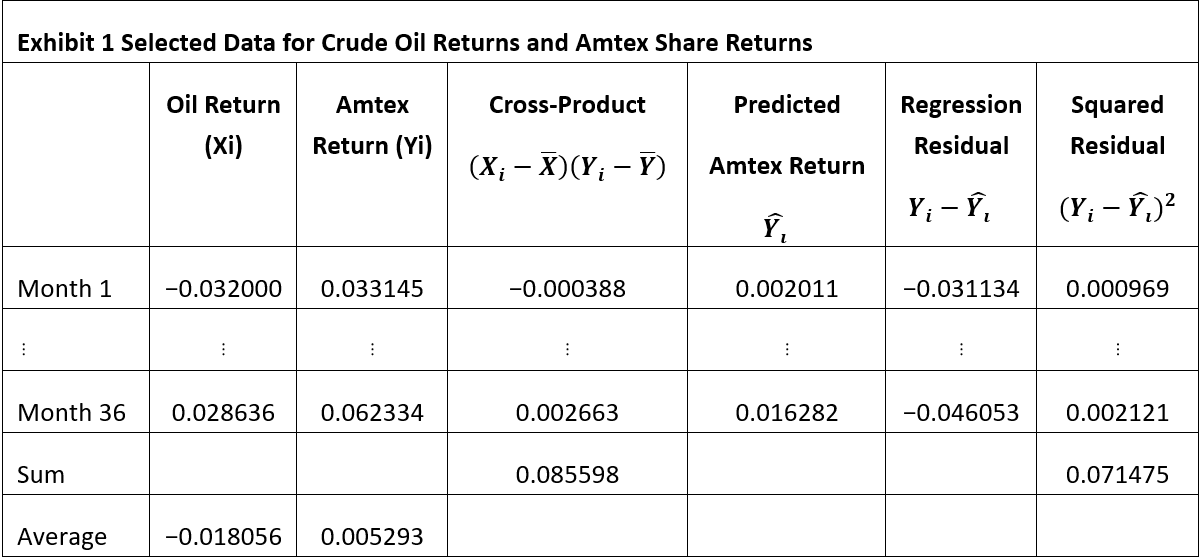

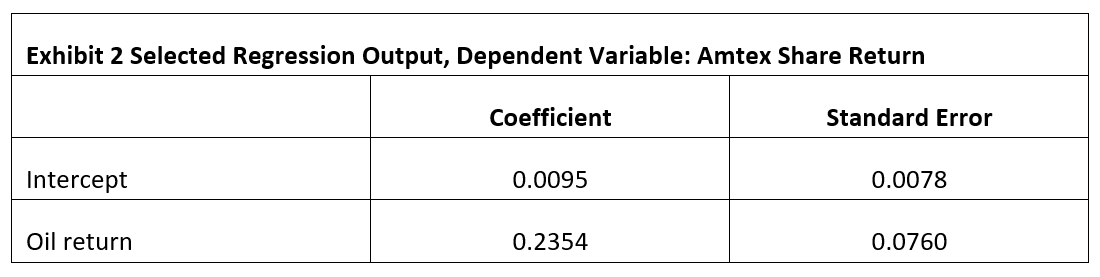

Crude oil returns explain the Amtex share returns if the slope coefficient is statistically different from zero. The slope coefficient is 0.2354, and the calculated t-statistic is

t=(0.2354-0.0000)/0.0760=3.0974,

which is outside the bounds of the critical values of ±2.728.

Therefore, Vasileva should reject the null hypothesis that crude oil returns do not explain Amtex share returns, because the slope coefficient is statistically different from zero.

A is incorrect because the calculated t-statistic for testing the slope against 0.15 is t=(0.2354-0.1500)/0.0760=1.1237,which is less than the critical value of +2.441.

B is incorrect because the calculated t-statistic is t=(0.0095-0.0000)/0.0078=1.2179, which is less than the critical value of +2.441.

-