NO.PZ2023032701000063

问题如下:

Raman collects additional data for valuing PBRI using the multistage RI model. For this model, he assumes an annual growth rate of residual income of 15% during the forecast horizon of 5 years (Years 1 to 5) and discounts the terminal year’s residual income as a perpetuity. Other inputs are found in Exhibit 3.

Exhibit 3 Data for Residual Income Model

Using the data in Exhibit 3, Raman's estimate of the contribution that the terminal value of the residual income stream in 5 years will contribute to the current value of equity is closest to:

选项:

A.$42.25

$61.91

$48.82

解释:

Using a multi-stage residual income model and the data in Exhibit 3:

Equity charge = Equity capital × Cost of equity capital= 20.97 × 0.124 = $2.60 million

Residual income of the more recent year = Net income – Equity charge= 8.00 – 2.60 = $5.40 million

Raman’s assumed growth rate during the forecast period of five years = 15%

Annual residual income during the no growth period (after Year 5) = 5.40 × (1.15)5 = $10.86

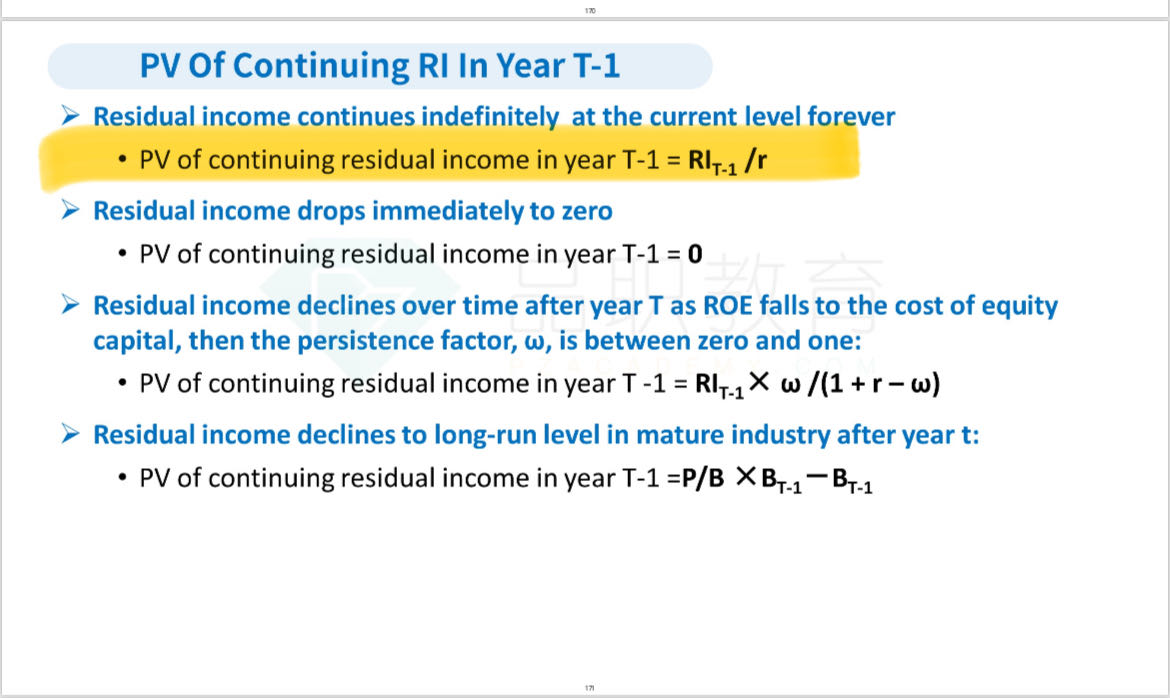

Present value (PV) of the residual income from perpetual period, as at T = 5 = ($10.86/0.124)=$87.58

PV of the perpetual period residual income at T0= 87.58/(1.124)5=$48.82

没太理解这道题的意思,老师麻烦可以帮忙详细解释下这道题吗?辛苦啦