NO.PZ2023091701000180

问题如下:

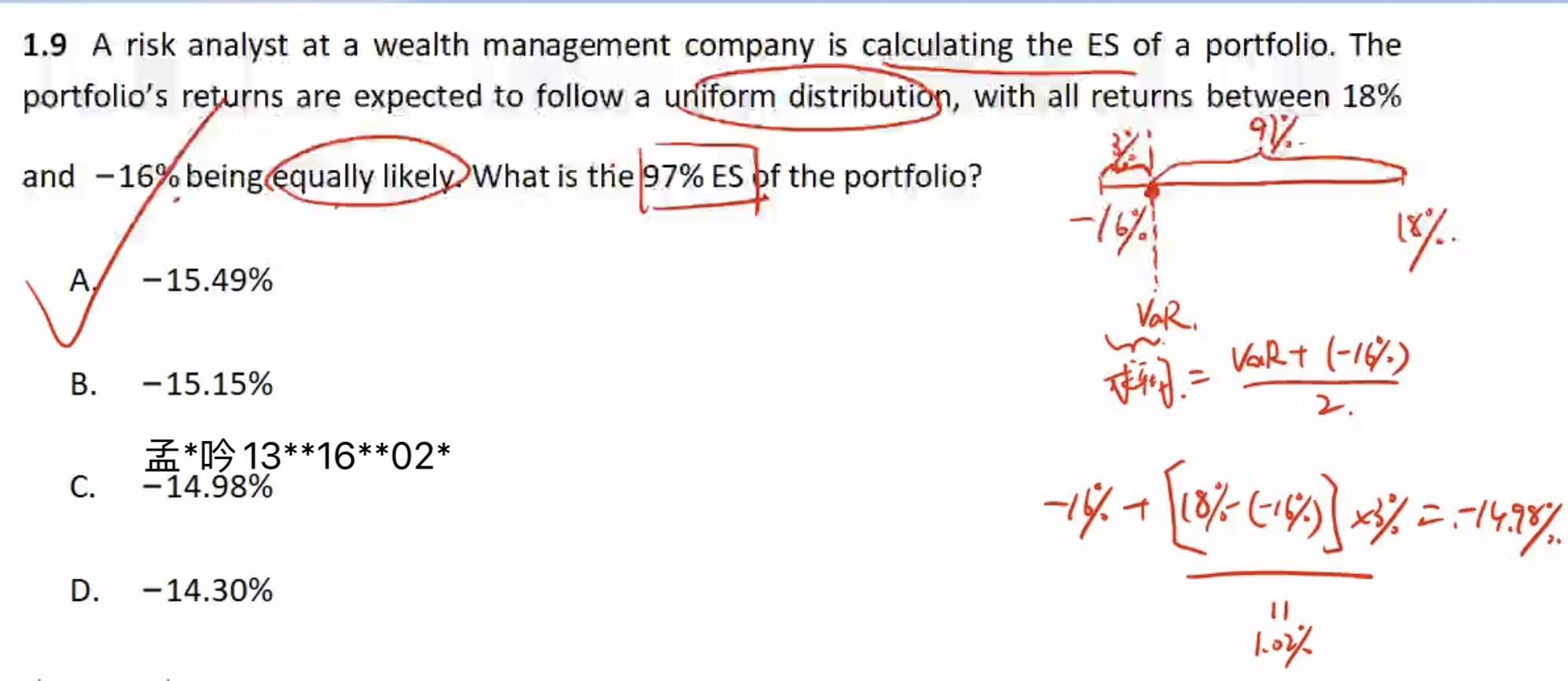

A risk analyst at a wealth management company is calculating the ES of a portfolio. The portfolio’s returns are expected to follow a uniform distribution, with all returns between 18% and −16% being equally likely. What is the 97% ES of the portfolio?

选项:

A.−15.49%

B.−15.15%

C.−14.98%

D.−14.30%

解释:

A is correct. Begin by calculating the 97% VaR. The range of returns is 18% − (−16%) = 34%. The left 3% tail therefore covers the range found as follows:

x/34% = 3%

x = 3% * 34% = 1.02%

Thus, the 97% VaR is −16% + 1.02% = −14.98%. The ES is halfway between −14.98% and −16%, or −15.49%.

B is incorrect. This is the 95% ES. (The 95% VaR is −16% + (5% * 34%) = −14.30%. The ES is therefore halfway between this and −16%, or −15.15%.)

C is incorrect. This is the 97% VaR.

D is incorrect. This is the 95% VaR.

老师好,这道题,97%的VAR分位点如果是-14.98%,求ES,用-16%-14.98%=-15.49%,这个求法与一级ES是超过VAR的损失求算术平均矛盾了。因为包括了VAR这个点啊…