NO.PZ202208220100000302

问题如下:

Identify the type of error and its impacts on regression Model A indicated by the data in Exhibit 2.

选项:

A.Serial correlation, invalid coefficient estimates, and deflated standard errors. B.Heteroskedasticity, valid coefficient estimates, and deflated standard errors. C.Serial correlation, valid coefficient estimates, and inflated standard errors.解释:

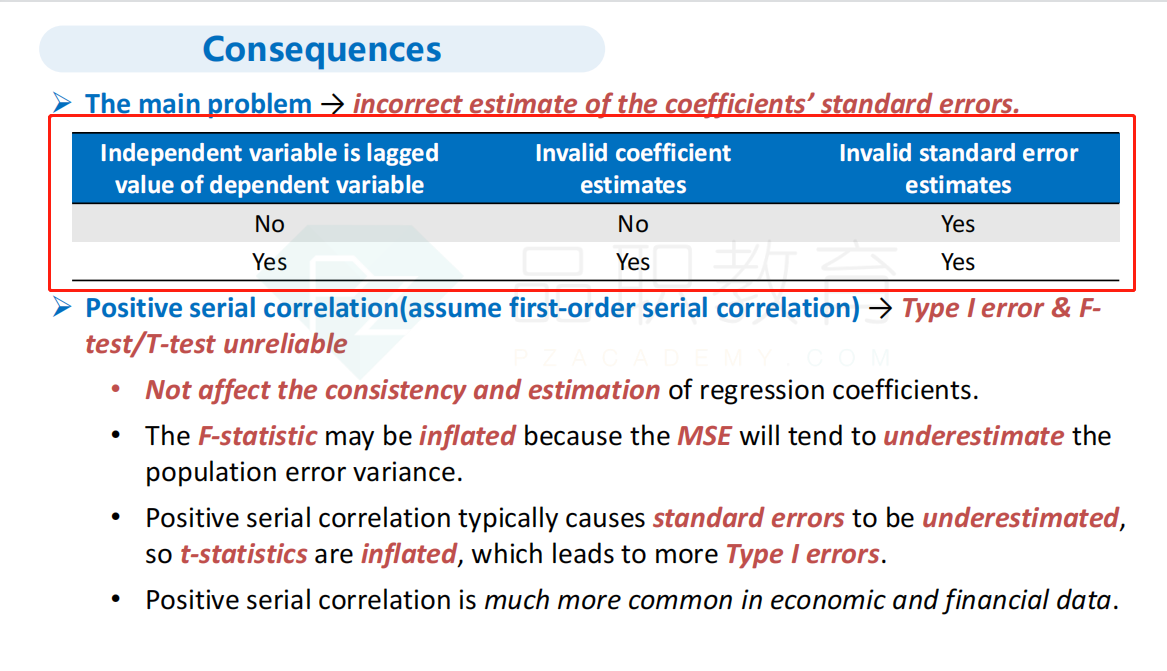

A is correct. The Breusch–Godfrey (BG) test is for serial correlation, and for Model A, the BG test statistic exceeds the critical value. In the presence of serial correlation, if the independent variable is a lagged value of the dependent variable,then regression coefficient estimates are invalid and coefficients’ standard errors are deflated, so t-statistics are inflated.

Serial correlation, 为什么是invalid coefficient estimates, 我看视屏讲解里归纳是不影响estimates和consisitency

这个条件来的。

这个条件来的。