13:24 (2X)

actual volatility小于expected为什么要short呀?不是未来波动率变大,我就可以转波动率变大的钱么?

发亮_品职助教 · 2024年09月04日

不是未来波动率变大,我就可以转波动率变大的钱么?

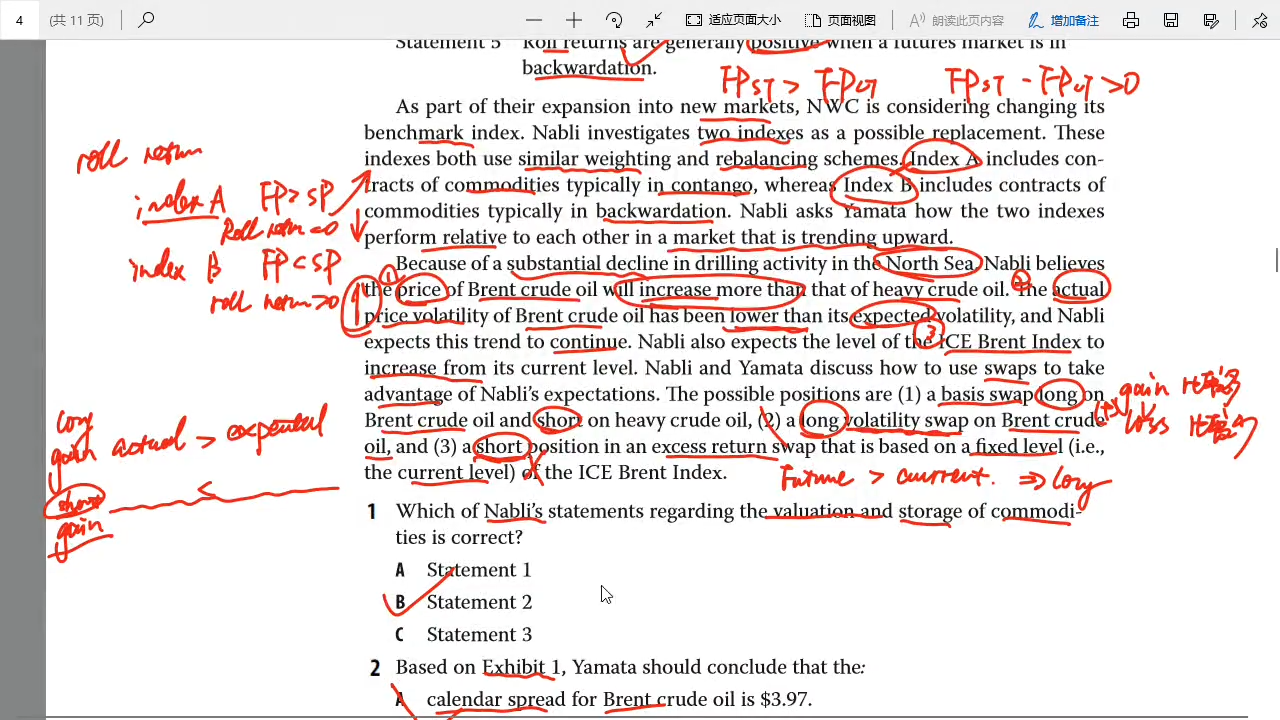

不是的。Volatility swap的盈亏要基于:合约约定的volatility(expected volatility)和实际实现的volatility(actual volatility)之间的大小。具体来说是:

Volatility swap里面约定的价格是expected volatility/Reference volatility,这是合约里面约定好的Volatility,合约一旦签订固定不变。

Volatility seller/Short volatility,就是看空Volatility,认为将来实现的Volatility要低于这个合约约定的expected volatility/Reference volatility;

Volatility buyer/long volatility,就是看多Volatility,认为将来实现的Volatility要高于这个合约约定的expected volatility/Reference volatility;

然后这个swap的盈亏要取决于未来实现的volatility(observed volatility/realized volatility/Actual)和合约里面约定好的expected volatility的大小。

(amount of payments are determined relative to the observed versus expected volatility for a reference price commodity)

如果未来实现的volatility(Realized volatilty/observed volatility/actual volatility)比合约里面约定的(expected volatility)要低,这时候Volatility seller,即看空一方——short方盈利。

如果未来实现的Volatility(Realized volatilty/observed volatility/actual volatility)比合约里面约定的(expected volatility)要高,这时候Volatility buyer,即看多一方——long方盈利。

这道题的题干信息是,未来实际实现的Actual volatility要比合约约定的expected volatility要低,且这个趋势会持续。那基于这样的预测,盈利的头寸应该是volatility seller/Short volatility。