NO.PZ2024021802000022

问题如下:

According to the Brunel Asset Management Accord, which of the following concerns are most likely of limited significance in evaluating an asset manager against an ESG investment mandate?选项:

A.Loss of key personnel

B.Change in investment style

C.Short-term underperformance

解释:

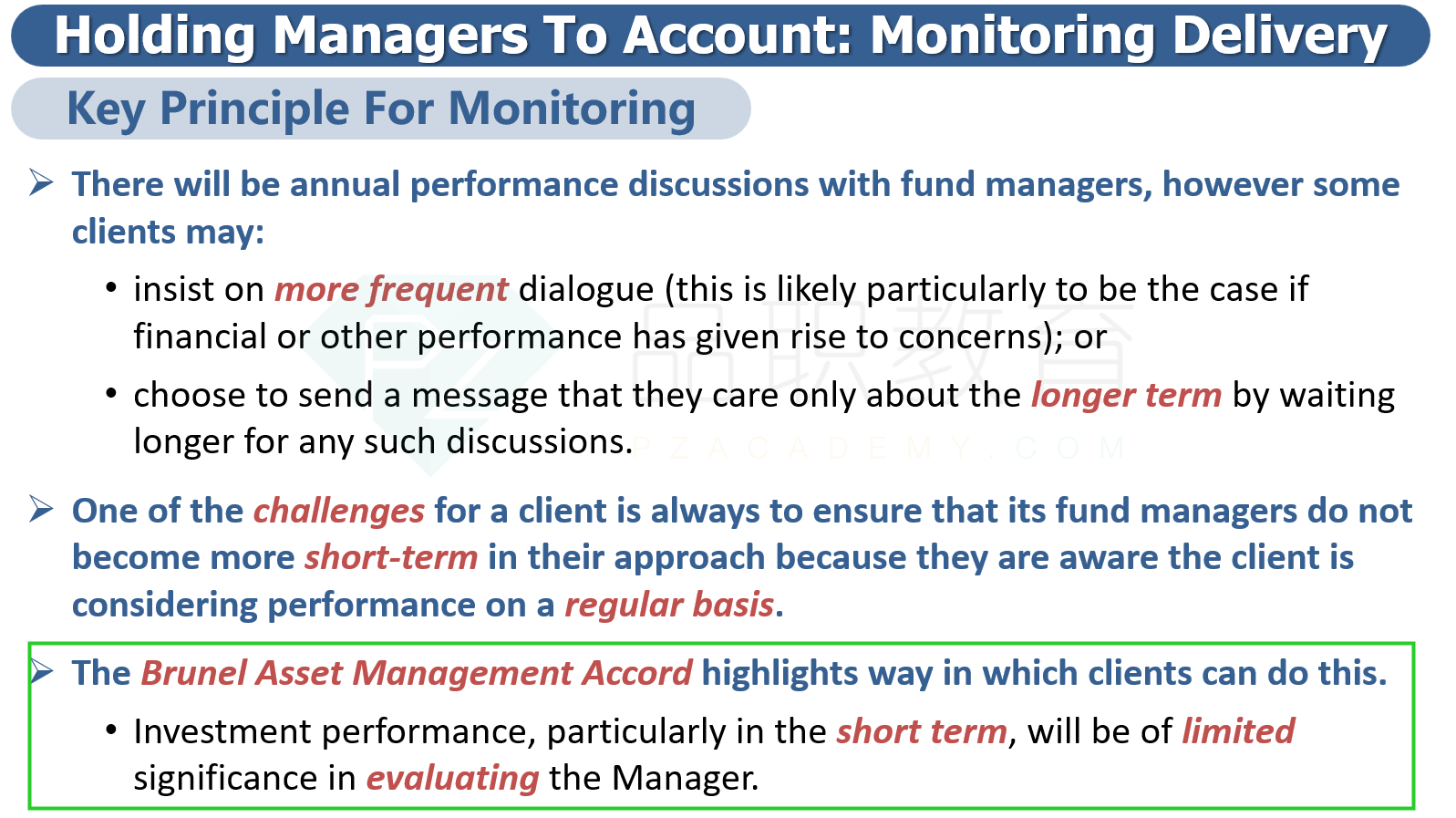

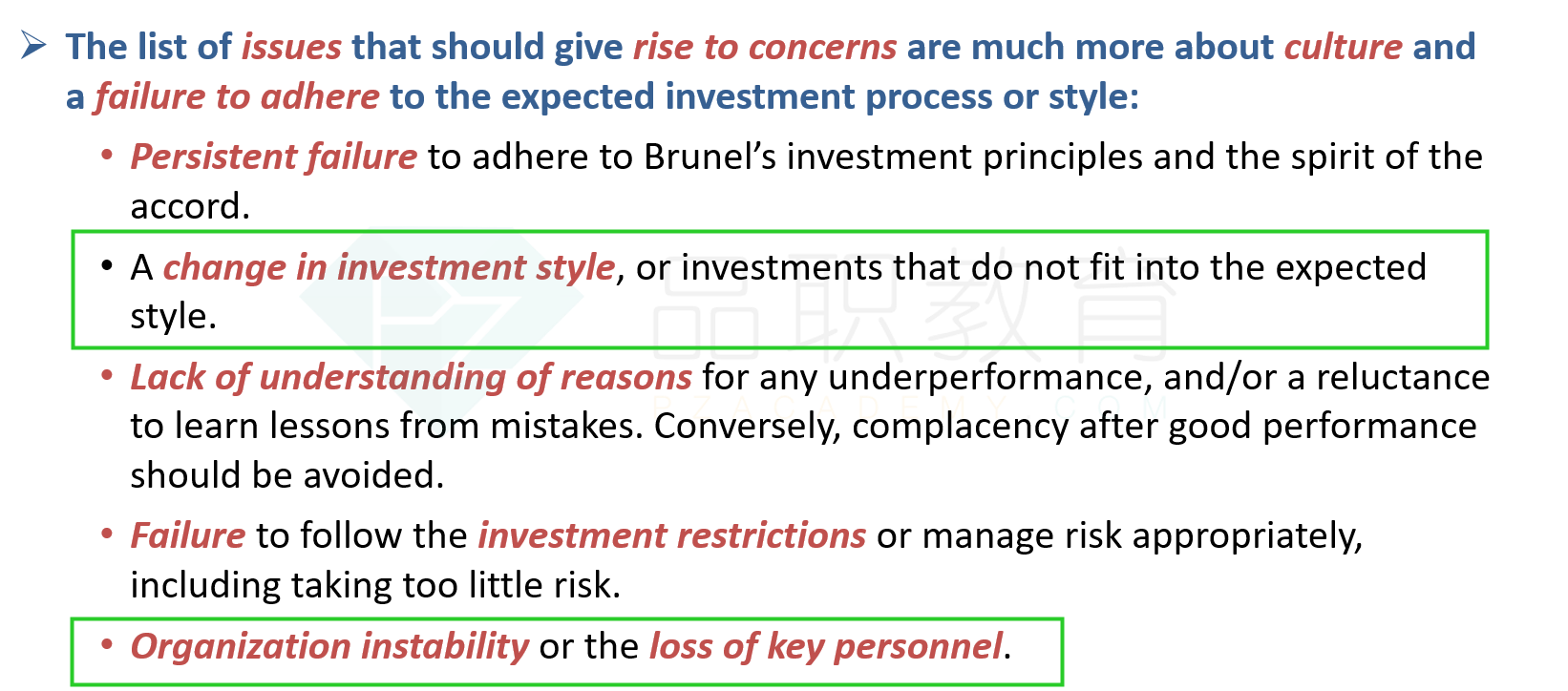

A is incorrectbecause the list of issues that the Brunel Asset Management Accord identifiesas likely to give rise to concerns are much more about culture and a failure toadhere to the expected investment process or style than about performance.These issues include organization instability or the loss of key personnel.

B is incorrectbecause the list of issues that the Brunel Asset Management Accord identifiesas likely to give rise to concerns are much more about culture and a failure toadhere to the expected investment process or style than about performance.These issues include a change in investment style, or investments that do notfit into the expected style.

C is correctbecause the document [Brunel Asset Management Accord] emphasizes thatshort-term underperformance is not in itself likely to give rise to undueconcern for the client: “Investment performance, particularly in the shortterm, will be of limited significance in evaluating the Manager.”

答案b为什么不对?投资风格转变不是最大的问题吗?