NO.PZ2023090502000008

问题如下:

Which of the following features least likely distinguish a general partnership from a limited partnership?

选项:

A.

Owner–manager relationship

B.

Owner liability of business debts and obligations

C.

Taxation

解释:

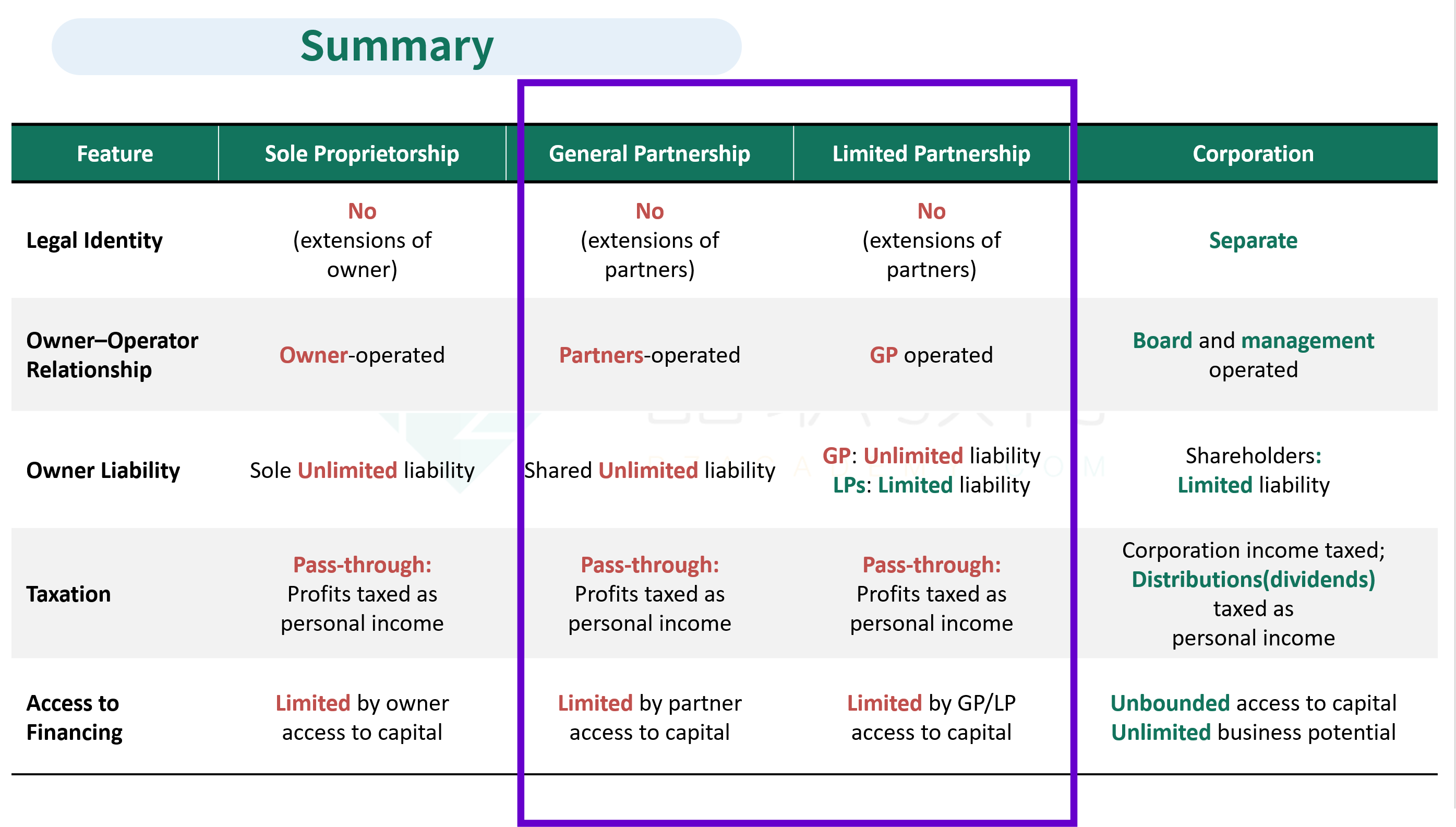

C is correct. Like sole proprietorships, partnerships are typically pass-through businesses for tax purposes. Pass-through businesses are not taxed at the entity level, passing on all their profits or losses to the partners who are taxed personally.

A is incorrect. The management of a general partnership is typically shared by the general partners, while in a limited partnership, the general partner often exercises most managerial responsibilities.

B is incorrect. In a general partnership, the partners are personally legally liable for business debt and actions undertaken by the company. In a limited partnership, only the general partner faces personal liability; limited partners’ liability is limited to their investment in the partnership.

题目是什么意思,另外limited partnership是什么。。。。。