NO.PZ2023071902000039

问题如下:

Question

Under perfect competition, three companies produce the same item in the amount of 600 units each but employ varied production methods. The cost structures for these firms are as follows:

Based on the following unit selling price, which statement is most accurate?

选项:

A.$10, every company should exit the market in the long run.

B.

$8, all companies should keep operating temporarily but depart the market in the long run if the situation remains the same.

C.

$5.20, Company A should keep operating in the short term, while Companies B and C should hut down production.

解释:

Solution

-

Incorrect. If total revenue equals or exceeds total costs, the firms should remain in the market both in the long and short run: each firm is just earning an economic profit, which includes its opportunity cost.

-

Incorrect. At $8, total revenue is $8 × 600 = $4,800. Only Firms X and Y cover their variable costs; Firm Z should shut down. It is true, however, that if conditions persist, all should shut down in the long run as they won’t be covering their total costs.

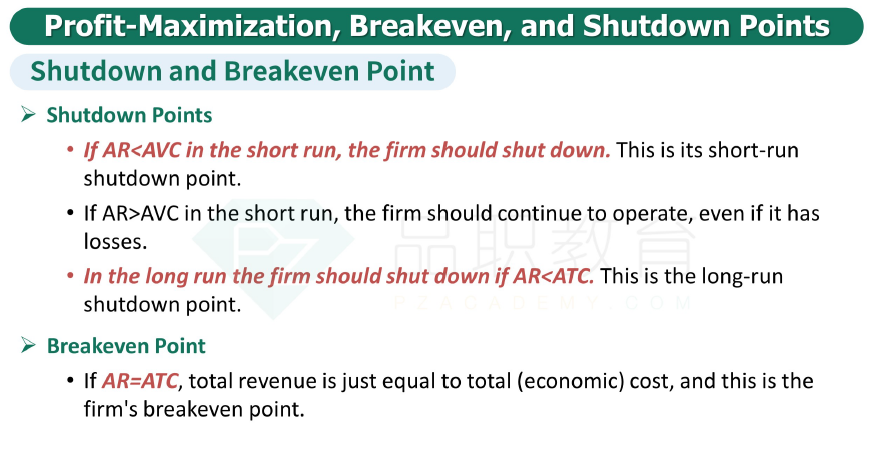

- Consequently, with a price point of $5.20, the total income for every enterprise would be $5.20 for each unit × 600 units = $3,120. firms A is the only one covering its variable costs and should proceed, while Businesses B and C ought to halt operations instantly.

The Firm and Market Structures

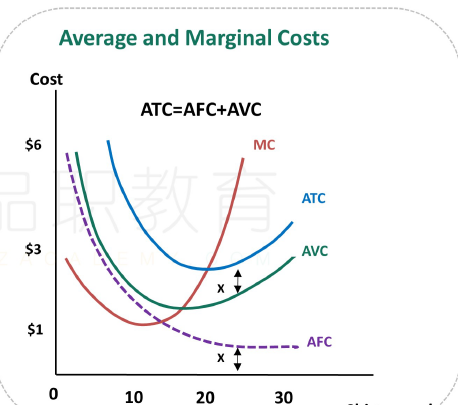

• determine and interpret breakeven and shutdown points of production, as well as how economies and diseconomies of scale affect costs under perfect and imperfect competition

A不正确的。如果总收入等于或超过总成本,那么企业在长期和短期内都应该留在市场上:每个企业都只赚取经济利润,其中包括其机会成本。

B不正确的。8美元时,总收益为8 × 600 = 4800美元。只有公司X和公司Y支付他们的可变成本;Z公司应该关闭。然而,如果情况持续下去,从长远来看,所有这些工厂都应该关闭,因为它们无法收回全部成本。

因此,价格点为5.20美元时,每个企业的总收入为每单位5.20美元× 600单位= 3120美元。企业A是唯一能够支付可变成本的企业,应该继续运营,而企业B和企业C应该立即停止运营。C正确。

老师能不能帮画下这三个firm的成本线,感觉可以在图形里找到答案,但是忘记怎么画图了