NO.PZ2018123101000028

问题如下:

Investor buys a lower-quality, two-year corporate bond with a coupon rate of 4.15%. Exhibit below shows the Government Spot Rates. The Z-Spreads for the corporate bond is 0.65%.

The bond is most likely trading at a price of:

选项:

A.100.97.

B.101.54.

C.104.09.

解释:

B is correct.

考点:考察Z-spread概念

解析:

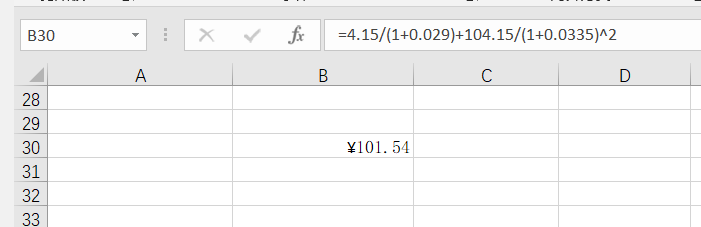

由题干已知公司债的Z-spread为0.65%,也已知国债的Spot rate,则这个2年期公司债对应的折现率为:

r(1) = 2.90% = 2.25% + 0.65%,

r(2) = 3.35% = 2.70% + 0.65%,则其价格为:

p=(1+0.029)1

4.15

+(1+0.0335)2

100+4.15

=101.54

计算机计算出来的结果不对