NO.PZ2024011002000091

问题如下:

Assume U.S. GAAP applies unless otherwise noted. An analyst determined the following information concerning Franklin, Inc.’s stamping machine:

As of December 31,

2004, the stamping machine is expected to generate $1,500,000 per year for five

more years and will then be sold for $1,000,000. The stamping machine is:

选项:

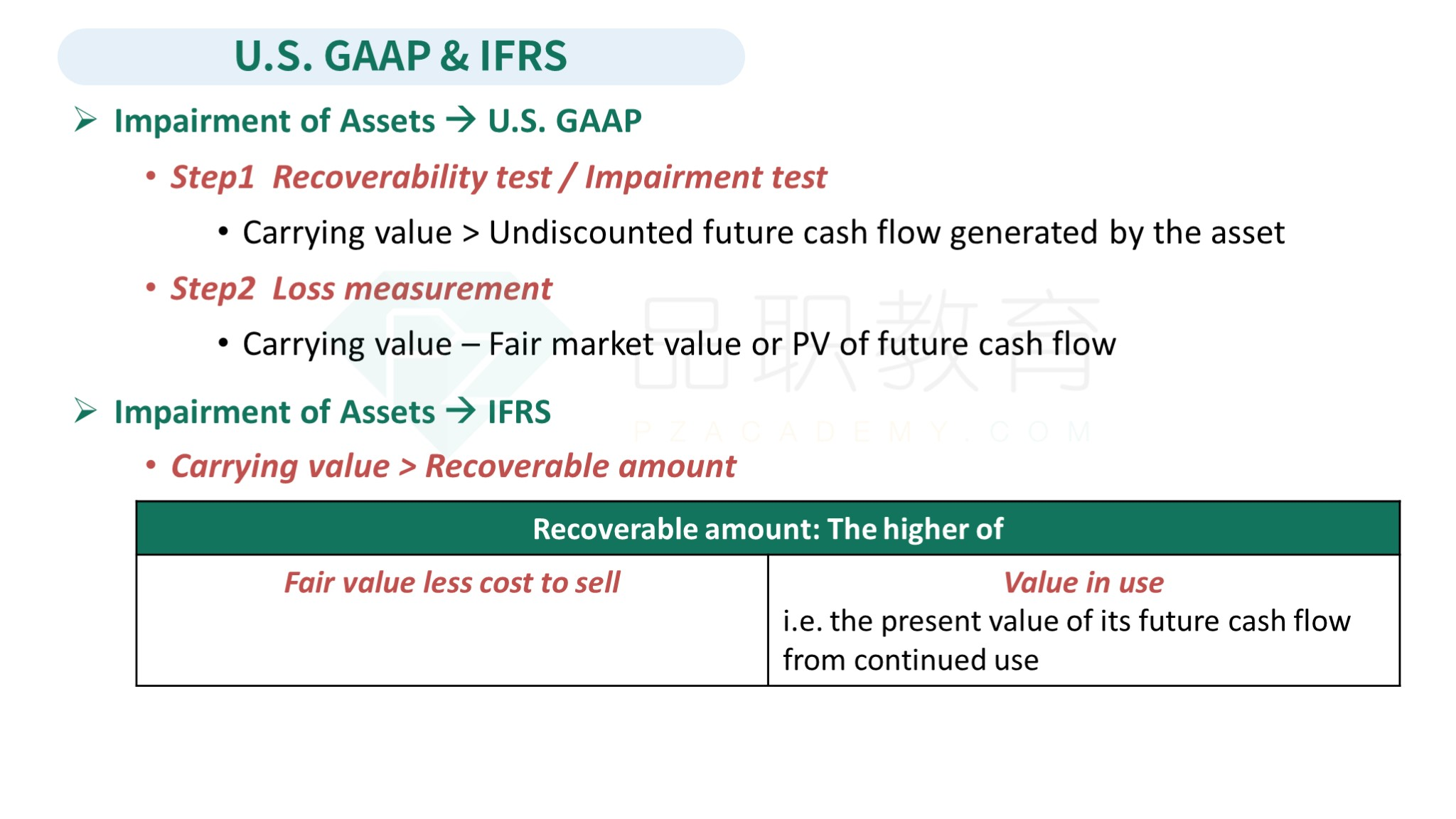

A.impaired because its carrying value exceeds expected future cash flows. B.impaired because expected salvage value has declined. C.Not impaired because annual expected revenue exceeds annual depreciation.解释:

The carrying value of the stamping machine is its cost less accumulated depreciation. Depreciation taken through 2004 was (($22,000,000 - $4,000,000) / 12*7 =) $10,500,000 so carrying value is ($22,000,000 - $10,500,000 =) $11,500,000. Because the $11,500,000 carrying value is more than expected future cash flows of ((5*$1,500,000) + $1,000,000 =) $8,500,000, the stamping machine is impaired.its carrying value exceeds expected future cash flows.怎么能叫减值呢?这不增值了吗?

减值不应该是现在的价值低吗?