NO.PZ2023091701000023

问题如下:

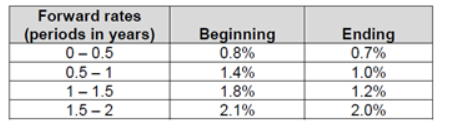

A fixed-income analyst is decomposing the profit and loss (P&L) of a bond over the past 6 months. The bond has a 2% coupon rate, paid semi-annually, and had exactly 2 years remaining until maturity at the start of the 6-month period. Relevant information about the bond and market rates (semi-annually compounded) is shown below:

The analyst has calculated the bond’s carry roll-down, and under the forward rate assumption made for the purpose of that calculation, the ending value of the bond is SGD 100.55. Given this information, what is the component of the bond’s P&L attributable to the change in rates over the 6-month period?

选项:

A.SGD 0.54

B.SGD 0.69

C.SGD 0.74

D.SGD 0.99

解释:

A is correct. Calculating the impact of the change in rates is the second step in decomposing the P&L of a bond, after calculating the carry roll-down. The impact of a rate change is calculated as the value of the bond at the end of the period using the ending forward rate curve (and the bond’s beginning-of-period spread), minus the end-of-period value of the bond calculated using the forward rates assumed for the purpose of determining carry roll-down (which represent some sense of “no change” in the interest rate environment). The value of the bond under the ending forward rate curve is:

Therefore, the impact of the rate change is:

SGD 101.09 - SGD 100.55 = SGD = 0.54

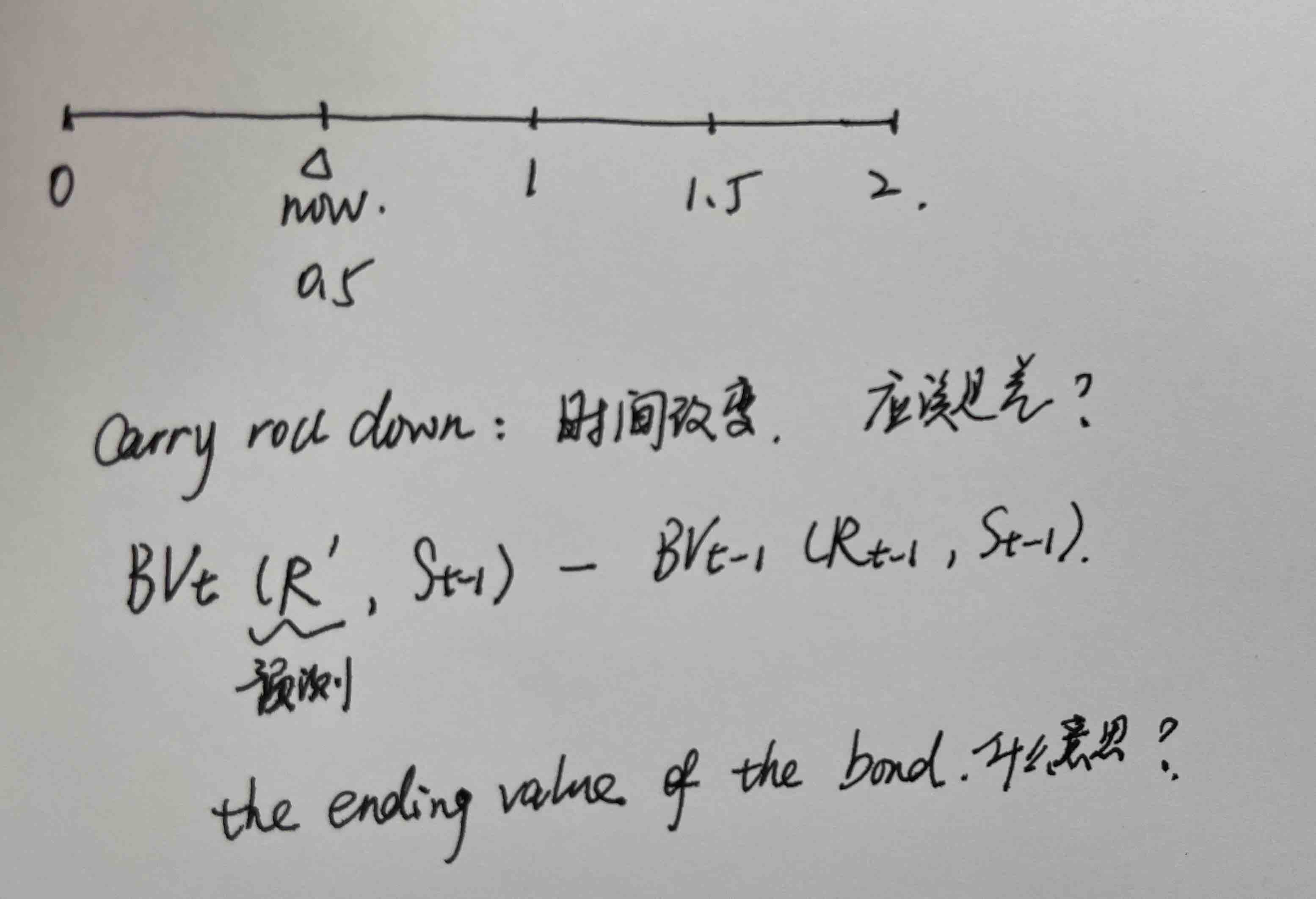

老师,

1、在真题中,forward rate 也会给的这么不清楚吗?这里的forward rate 到底是在0时刻,0.5至1的利率,还是0.5时刻?forward rate 不应该是站在现在时刻,未来某一时间开始到更未来的利率吗?但听了讲解,感觉是站在0.5时刻。

而且既然是forward rate,还有啥真实的利率的概念?就是ending ?真实的就是当前市场的吧,还能是forward rate吗?这里不是特别明白。

2、计算carry roll down明明是个债券价值差的概念

the ending value of the bond是BVt(R’ St-1)的通用表述吗?这题的英文和表格,整体都感觉不清不楚,真题也这样吗?