NO.PZ2023040501000124

问题如下:

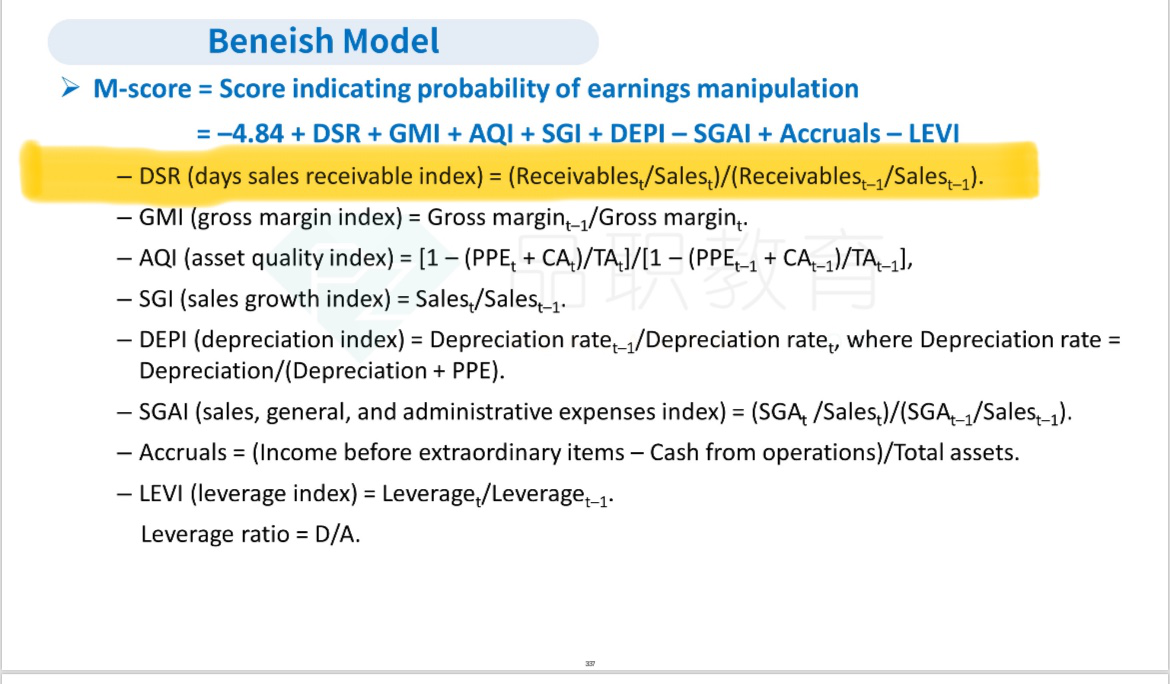

Andrei prepares a Beneish Model analysis, shown in Exhibit 3, to assess the likelihood that Galaxy is manipulating its earnings. He recalls that an M-score of –1.78 corresponds to a probability of earnings manipulation of 3.8%.

Exhibit 3 Galaxy 2014 Beneish Model M-Score Determination

Which of the following from Andrei’s Beneish M-score determination is the best indicator that Galaxy could be manipulating earnings?

选项:

A.

The total M-score

B.

The days sales in receivable index

C.

The leverage index

解释:

B is correct. A DSRI (days sales in receivable index) greater than 1 indicates an inappropriate relationship between accounts receivable and revenue recognition and is a potential signal of earnings manipulation. For Galaxy, it is the largest positive contributor (DSRI = 1.619) that would increase the M score. Larger values for the M-score (and contributors) are more indicative of earnings manipulation. Increasing leverage could predispose a company to manipulate earnings, but here the leverage index is negative indicating that leverage has decreased.

A is incorrect. Higher M-scores (less negative) indicate an increased probability of earnings manipulation. Here the lower (more negative score) would indicate that the company is less likely to be manipulating earnings.

C is incorrect. Increasing leverage could predispose a company to manipulate earnings, but here the leverage index is negative, indicating that leverage has decreased.

DSRI大于1为什么就有操作可能呢