NO.PZ2016012102000113

问题如下:

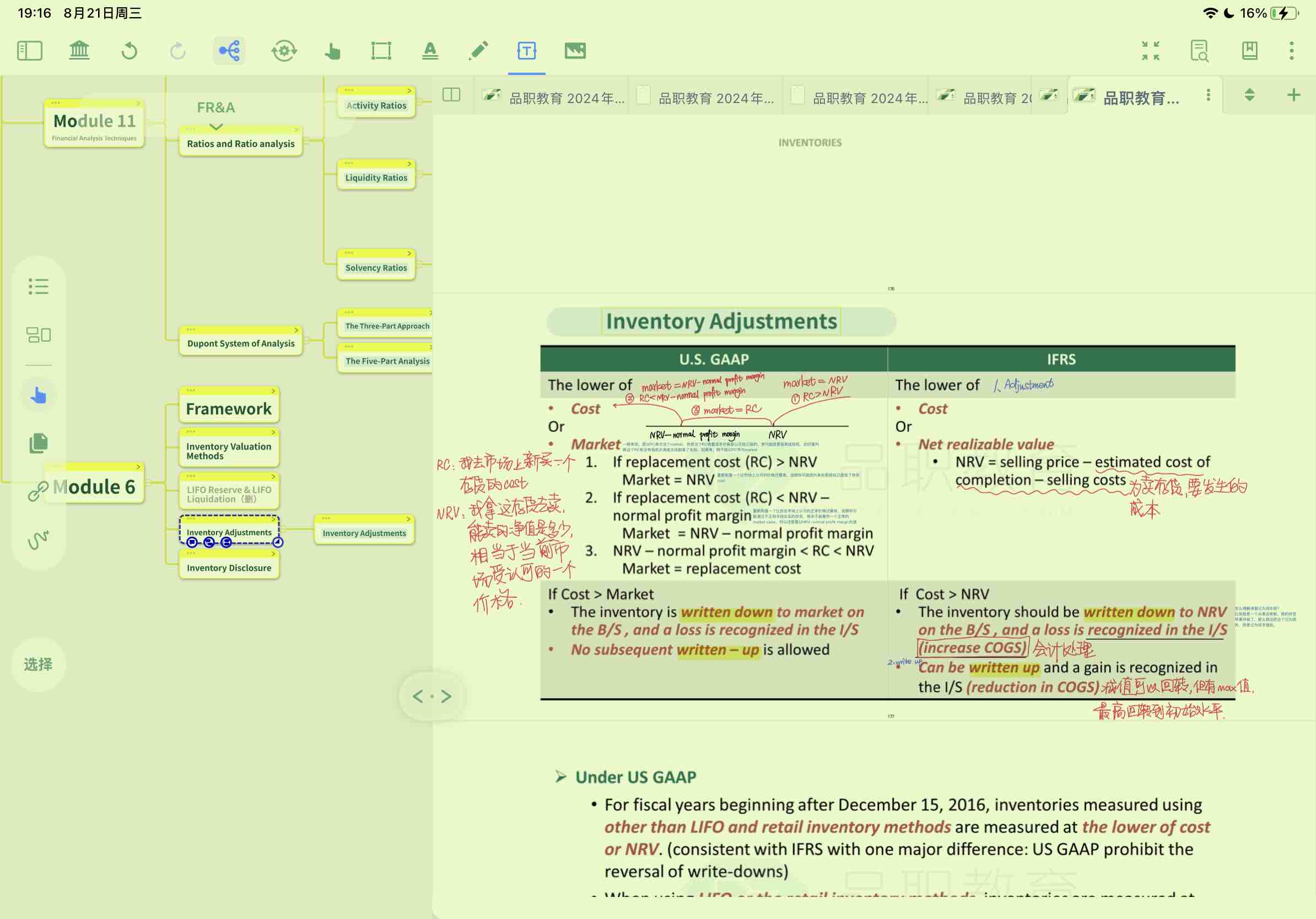

Goodluck Company under IFRS wrote its inventory value down from cost of $10,000 to net realizable value of $8,000. Which of the following is least likely regarding the financial statement effect of this change.

选项:

A.

loss reported as other comprehensive income.

B.

a seperate line item.

C.

increase in cost of sales.

解释:

A is correct.

If inventory writedown, will increase in cost of sales and a seperate line item on the income statement,

考点:LIFO和FIFO

如果存货发生减值,会增加在销售成本中,并单独列示(a seperate line item).

课件没有展开说,可以详细说一下美国准则和国际准则分别怎么做吗