NO.PZ201710200100000403

问题如下:

Elena Castovan is a junior analyst with Contralith Capital, a long-only equity investment manager. She has been asked to value three stocks on Contralith’s watch list: Portous, Inc. (PTU), SSX Financial (SSX), and Tantechi Ltd. (TTCI).

During their weekly meeting, Castovan and her supervisor, Ariana Beckworth, discuss characteristics of residual income (RI) models. Castovan tells Beckworth the following.

· Statement 1: The present value of the terminal value in RI models is often a larger portion of the total intrinsic value than it is in other DCF valuation models.

· Statement 2: The RI model’s use of accounting income assumes that the cost of debt capital is appropriately reflected by interest expense.

· Statement3: RI models cannot be readily applied to companies that do not have positive expected near-term free cash flows.

Beckworth asks Castovan why an RI model may be more appropriate for valuing PTU than the dividend discount model or a free cash flow model. Castovan tells Beckworth that, over her five-year forecast horizon, she expects PTU to perform the following actions.

· Reason 1: Pay dividends that are unpredictable

· Reason 2: Generate positive and fairly predictable free cash flows

· Reason 3: Report significant amounts of other comprehensive income

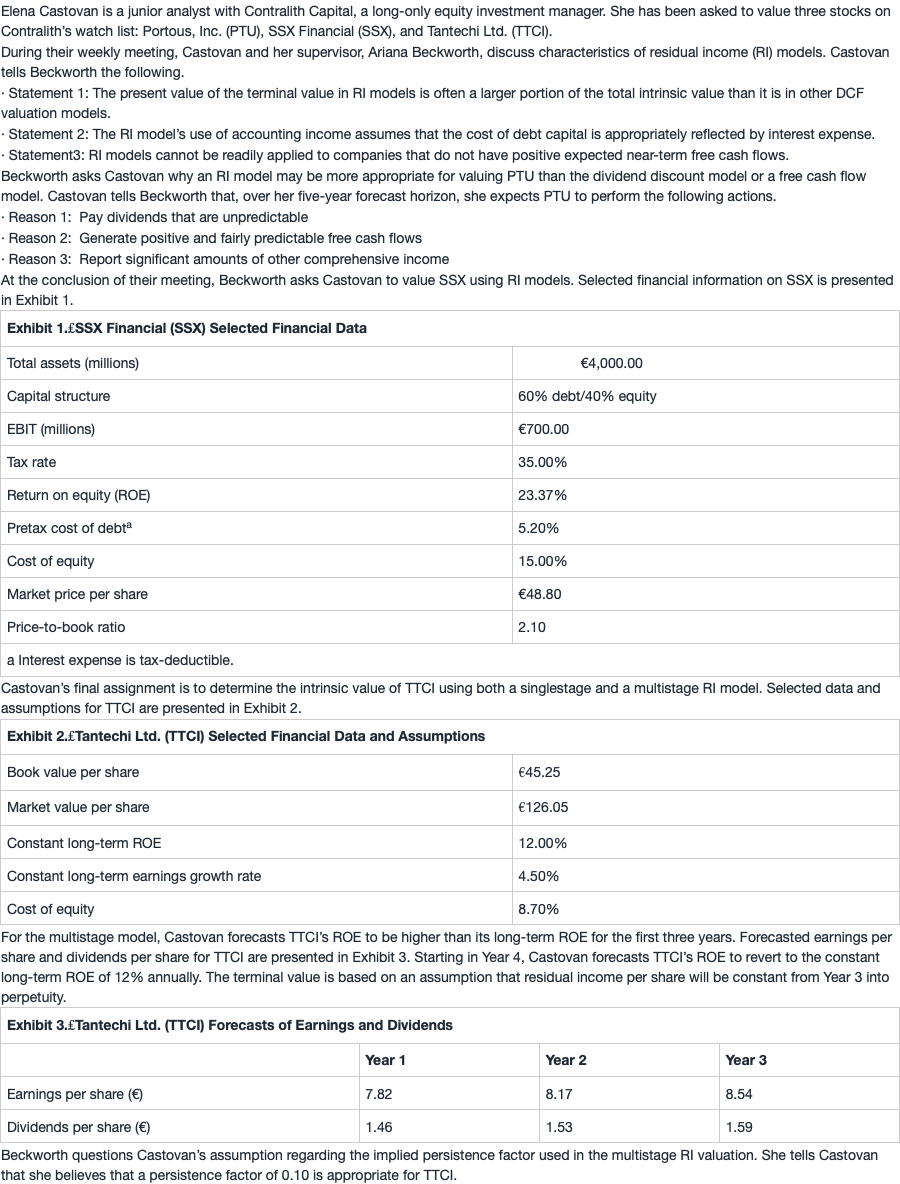

At the conclusion of their meeting, Beckworth asks Castovan to value SSX using RI models. Selected financial information on SSX is presented in Exhibit 1.

Castovan’s final assignment is to determine the intrinsic value of TTCI using both a singlestage and a multistage RI model. Selected data and assumptions for TTCI are presented in Exhibit 2.

For the multistage model, Castovan forecasts TTCI’s ROE to be higher than its long-term ROE for the first three years. Forecasted earnings per share and dividends per share for TTCI are presented in Exhibit 3. Starting in Year 4, Castovan forecasts TTCI’s ROE to revert to the constant long-term ROE of 12% annually. The terminal value is based on an assumption that residual income per share will be constant from Year 3 into perpetuity.

Beckworth questions Castovan’s assumption regarding the implied persistence factor used in the multistage RI valuation. She tells Castovan that she believes that a persistence factor of 0.10 is appropriate for TTCI.

3. The forecasted item described in Reason 3 will most likely impact:

选项:

A.earnings per share.

B.dividends per share.

C.book value per share.

解释:

C is correct.

Other Comprehensive Income (OCI) bypasses the income statement and goes directly to the statement of stockholders’ equity (which is a violation of the clean surplus relationship). Therefore, book value per share for PTU will be impacted by forecasted OCI.

https://class.pzacademy.com/qa/176020 这道题的结论是Equity的Book Value不变;但是本题结论是Equity的Book Value是变的