NO.PZ2016012102000123

问题如下:

Which of the following statements is most likely correct under U.S. GAAP?

选项:

A.

An asset is impaired when the carrying amount of the firm asset is unable to fully recover.

B.

An asset is impaired when acquisition cost is smaller than the sum of accumlated depreciation and salvage value.

C.

An asset is impaired when the discounted future cash flows from the asset is larger than its carrying value.

解释:

A is correct.

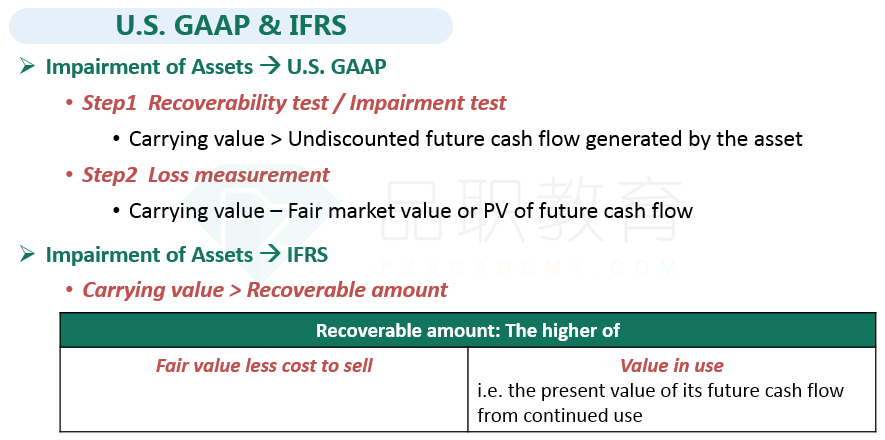

Under U.S. GAAP, an asset is impaired when the carrying amount of the firm asset is unable to fully recover. The recoverability should be compared to the undiscounted future cash flows.

考点:资产减值

根据美国公认会计原则,当公司资产的账面价值无法完全收回时,资产就会发生减值。

减值分为两步,第一步减值测试是用carrying value和undiscounted future cash flow比较,如果carrying value过大,则应该减值,那么就到了第二步:要决定减多少,是用carrying value减去fair value或者PV of future cash flow。

请老师解答一下A选项,谢谢