NO.PZ2023021601000026

问题如下:

With respect to capital market theory, an investor’s optimal portfolio is the combination of a risk-free asset and a risky asset with the highest: (原版书)选项:

A.expected return. B.indifference curve. C.capital allocation line slope.解释:

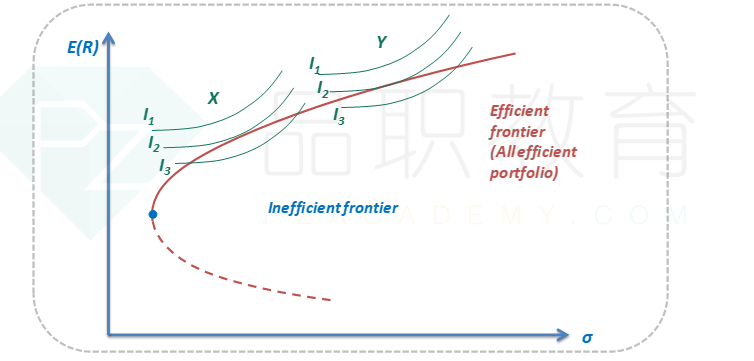

Investors will have different optimal portfolios depending on their indifference curves. The optimal portfolio for each investor is the one with highest utility; that is, where the CAL is tangent to the individual investor’s highest possible indifference curve.之前做题说indifference curve的斜率,怎么能用Highest来形容?