NO.PZ202303150300000403

问题如下:

Using Yee’s base case valuation assumptions and the FCFF valuation approach, the year-end 2012 value per share of McLaughlin common stock is closest to:选项:

A.$29.20. B.$12.78. C.$23.73.解释:

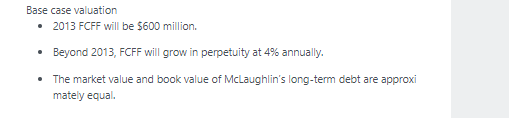

SolutionC is correct. In the base case, the growth rate is stable, thus using the constant-growth FCFF model the value of the firm is

Equity value = Firm value – Market value of debt = 12,000 – 2,249 = $9,751 million.

Value per share = Equity value/Number of shares

= 9,751 million/411 million

= 23.7251 = $23.73 per share

A is incorrect. It does not deduct the market value of debt: $12 million/411 million shares = $29.20.

B is incorrect. It uses cost of equity, not WACC: [600/(0.12 – 0.04) – 2249]/411 = 12.78.

这个12000是怎么算出来得,我算的是15000