NO.PZ2023020101000002

问题如下:

Ryan Parisi is a managing

director at High Ridge Partners, an investment management firm whose client

base is primarily US pension funds. He specializes in advising institutional

clients on the use of derivatives in their portfolio management strategies.

Parisi is preparing for a meeting with his client Leslie Sheroda who manages

the Quantum pension fund.

Leslie Sheroda oversees

both equity and fixed-income portfolios for Quantum. She has asked Parisi to

assist her in evaluating the derivatives positions held in the pension fund.

Sheroda asks Parisi to provide some background on derivative contracts. Parisi

makes the following comments:

Which of the comments

that Parisi makes to Sheroda describing derivative contracts is least likely

correct?

选项:

A.Comment 2

B.Comment 3

Comment 1

解释:

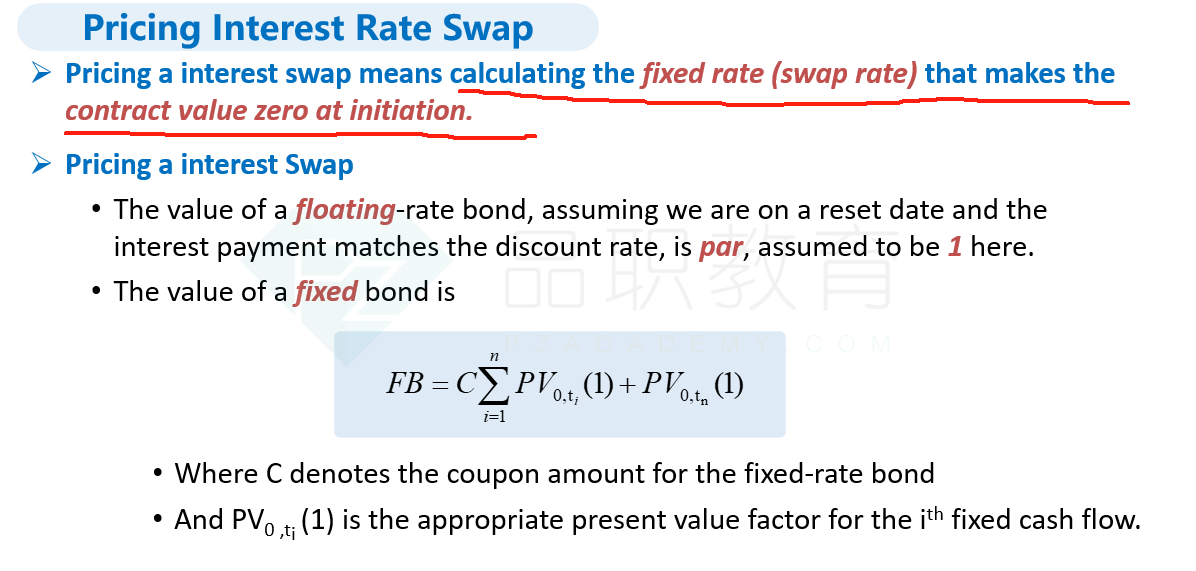

Parisi is incorrect with regard to Comment 2. As a result of the no-arbitrage approach, when the forward contract is established, the forward price is negotiated so that the market value of the forward contract on the initiation date is zero.

老师,我不太明白comment 3 , price 怎么是使value=0 的价格?

然后,我看了下面的解释,什么是交割价格? 是Fixed rate ? 使value为0 的远期价格是 FP么?

Quote:

forward相关的price有两个:

- 交割价格:期初签订远期合约时确定的交割价格是永远不变的。

- 远期价格:这是使的远期合约价值为0时的交割价格。由于后续value会产生变动,那么签订合约后,远期价格也是变化的,但一般不会变为负数。

Unquote