NO.PZ2019042401000058

问题如下:

A portfolio manager is revising an equity portfolio with the goal of attaining the optimal portfolio on the portfolio’s efficient frontier. The manager believes this goal can be achieved by replacing a stock in the portfolio with a new stock that is not part of the existing portfolio and keeping the portfolio value constant. The manager considers the following alternative actions:

• Action 1: Sell the stock with the highest marginal VaR and purchase an equivalent value of a new stock that would have the lowest marginal VaR in the portfolio.

• Action 2: Sell a particular stock and purchase an equivalent value of a new stock, which would cause the ratio of expected excess returns to portfolio beta for all stocks in the portfolio to be equal.

• Action 3: Sell a particular stock and purchase an equivalent value of a new stock, which would cause the portfolio betas of all stocks in the portfolio to be equal.

• Action 4: Sell a particular stock and purchase an equivalent value of a new stock, which would significantly decrease the portfolio standard deviation without changing the average excess portfolio return.

Which of the actions above would create an optimal portfolio?

选项:

A.Action 1

Action 3

Action 2

Action 4

解释:

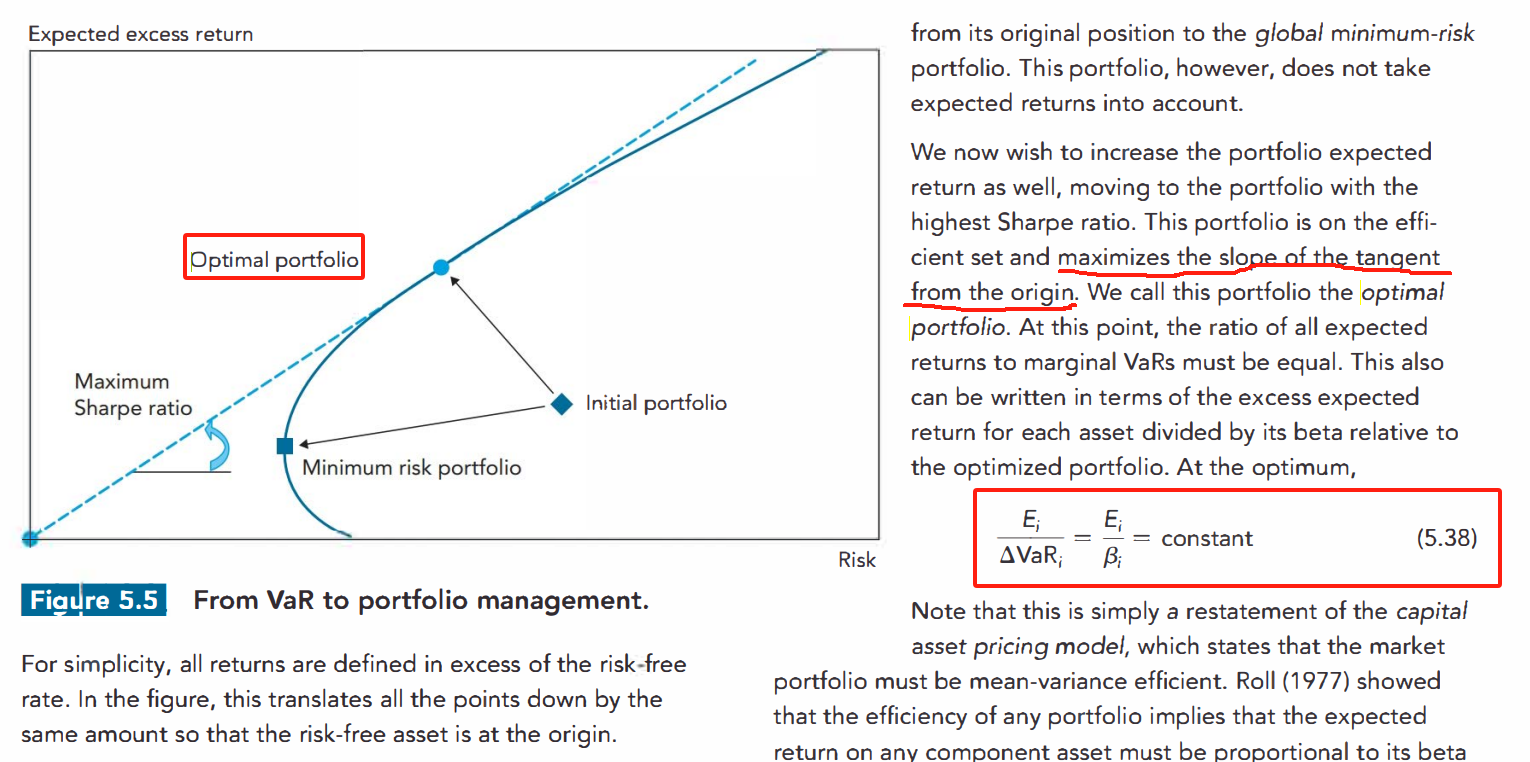

C is correct. The optimal portfolio is on the efficient frontier. It is the one that maximizes the slope of the tangent from the origin. At this point, the ratio of expected excess returns to portfolio beta (or marginal VaR) for all stocks in the portfolio is equal.

A is incorrect. This action would only minimize the risk of the portfolio. B is incorrect. This action would only minimize the risk of the portfolio.

D is incorrect. This action doesn’t necessarily create an optimal portfolio.

Risk Management and Investment Management

Explain the risk-minimizing position and the risk and return-optimizing position of a portfolio.

Philippe Jorion, Value-at-Risk: The New Benchmark for Managing Financial Risk, 3rd Edition (New York, NY: McGraw-Hill, 2007). Chapter 7. Portfolio Risk: Analytical Methods

求这道题的解题思路。。