NO.PZ2023091601000092

问题如下:

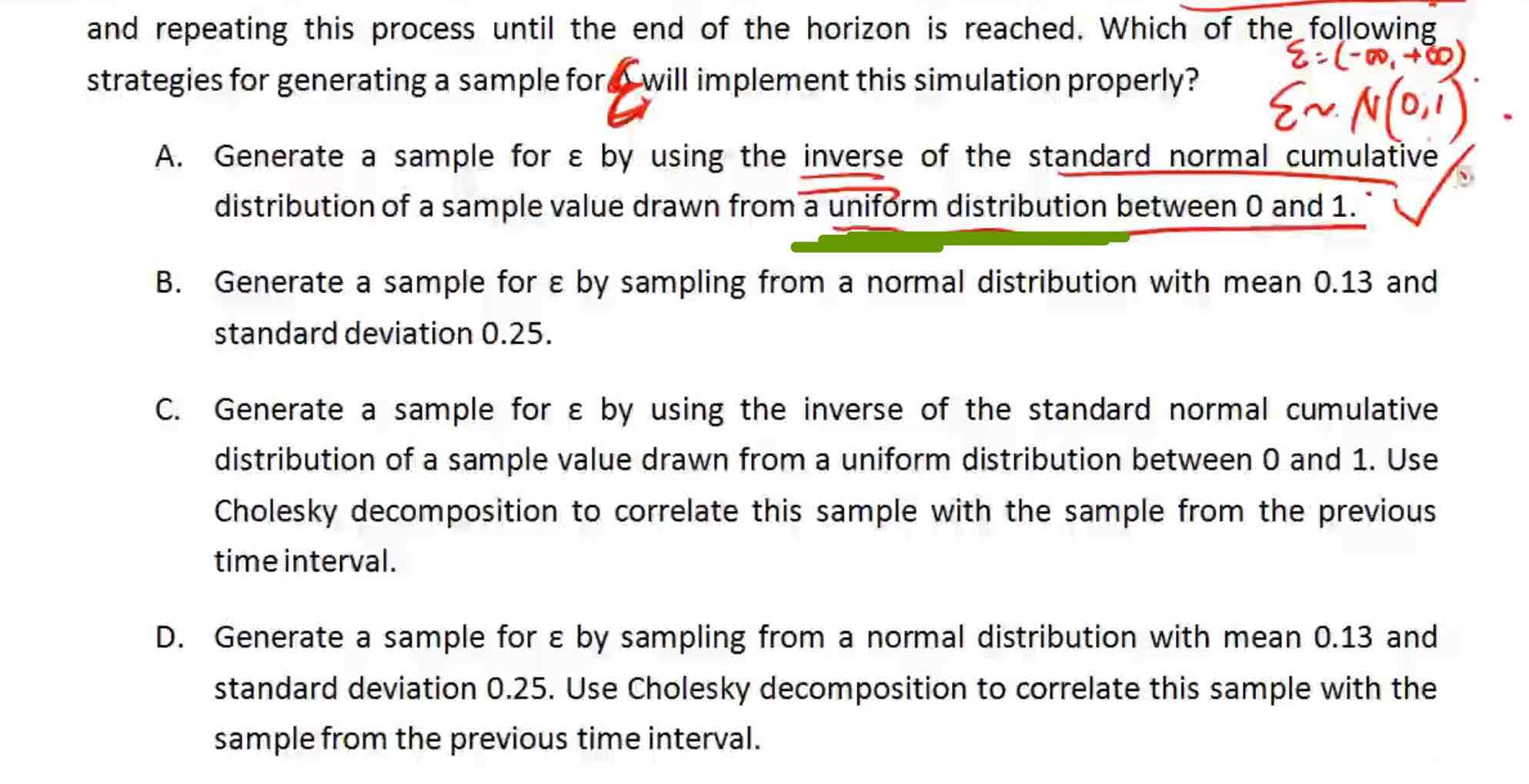

Consider a stock that pays no

dividends, has a volatility of 25% per annum and an expected return of 13% per

annum. Suppose that the current share price of the stock, S0, is USD 30. You

decide to model the stock price behavior using a discrete-time version of geometric

Brownian motion and to simulate paths of the stock price using Monte Carlo

simulation. Let Δt denote the time interval used and let St denote the stock

price at time interval t. So, according to your model,, whereεis a standard

normal variable.

To implement this

simulation, you generate a path of the stock price by starting at t = 0,

generating a sample for ε updating the stock price according to the model,

incrementing t by 1, and repeating this process until the end of the horizon is

reached. Which of the following strategies for generating a sample forεwill implement

this simulation properly?

选项:

A.

Generate a sample

for ε by using the inverse of the standard normal cumulative distribution of a

sample value drawn from a uniform distribution between 0 and 1.

B.

Generate a sample

for ε by sampling from a normal distribution with mean 0.13 and standard

deviation 0.25.

C.

Generate a sample

for ε by using the inverse of the standard normal cumulative distribution of a

sample value drawn from a uniform distribution between 0 and 1. Use Cholesky

decomposition to correlate this sample with the sample from the previous time

interval.

D.

Generate a sample

for ε by sampling from a normal distribution with mean 0.13 and standard

deviation 0.25. Use Cholesky decomposition to correlate this sample with the

sample from the previous time interval.

解释:

Monte Carlo

Simulation assumes independence across time so there is no need to correlate

samples from time period to time period, eliminating c and d. Choice a

describes a valid method for generating a sample from a standard normal

distribution.

老师好,绿色线的均匀分布和之前讲分布的均匀分布是一个概念吗?为什么正态分布/标准正态分布的反函数是均匀分布?