NO.PZ2023120801000089

问题如下:

For a long-term, zero-coupon bond, which of the following factors contributes to heightened difference between the bond’s yield convexity and curve convexity?

选项:

A.A flat yield curve

A price at or near par

A long time to maturity

解释:

Correct Answer: C

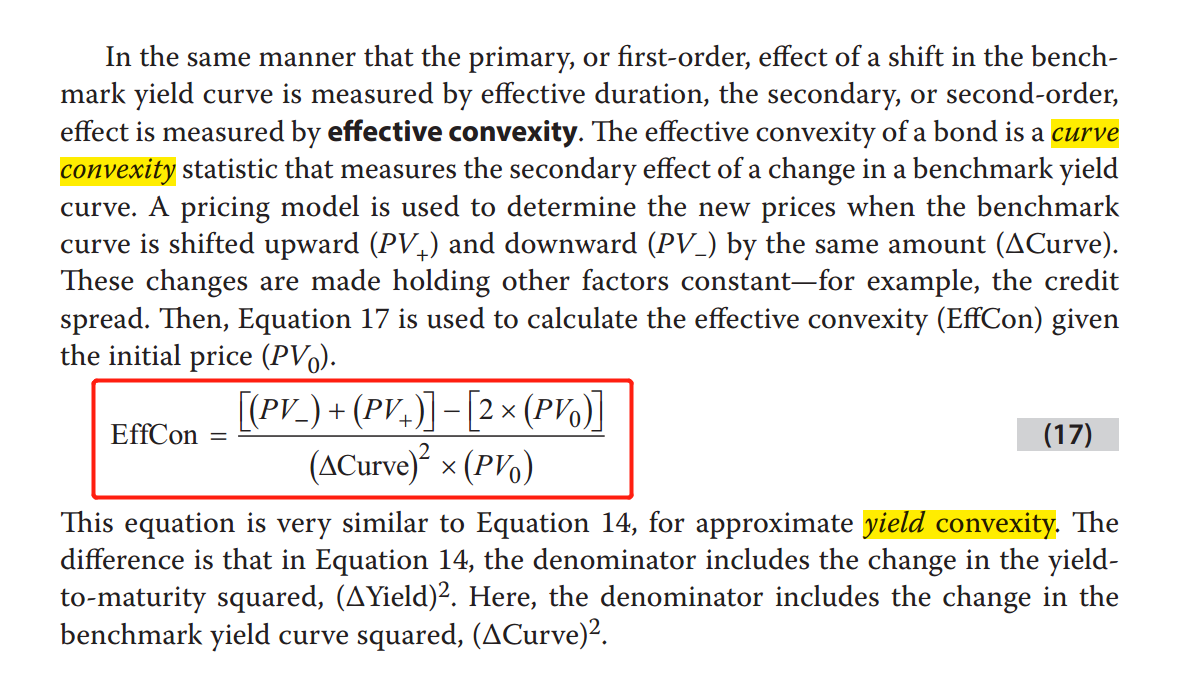

The difference between a zero-coupon bond’s yield convexity and curve convexity is heightened when the yield curve is not flat, the bond is priced at a significant discount or premium, and the bond has a long time to maturity.

A is incorrect because the difference between the bond’s yield convexity and curve convexity is heightened when the yield curve is not flat.

B is incorrect because the difference between the bond’s yield convexity and curve convexity is heightened when the bond is priced at a significant discount or premium (not when it is priced at or near par).

这个题目咋理解呀?知识点在哪里?