NO.PZ2023040701000002

问题如下:

Bird is analyzing a newly issued, US Treasury bond with a five year maturity and a 7.00% coupon. For other investors who may sell this US Treasury bond prior to maturity, Scott states that the future value of this bond is a function of expected future spot rates relative to the forward curve. Bird agrees, and states “let’s assume that an investor purchases this US Treasury bond at 101.5, to yield 6.72% to maturity. He then holds the bond for two years, at which time the 1 year, 2 year and 3 year spot interest rates are each assumed to equal 8.00%.”

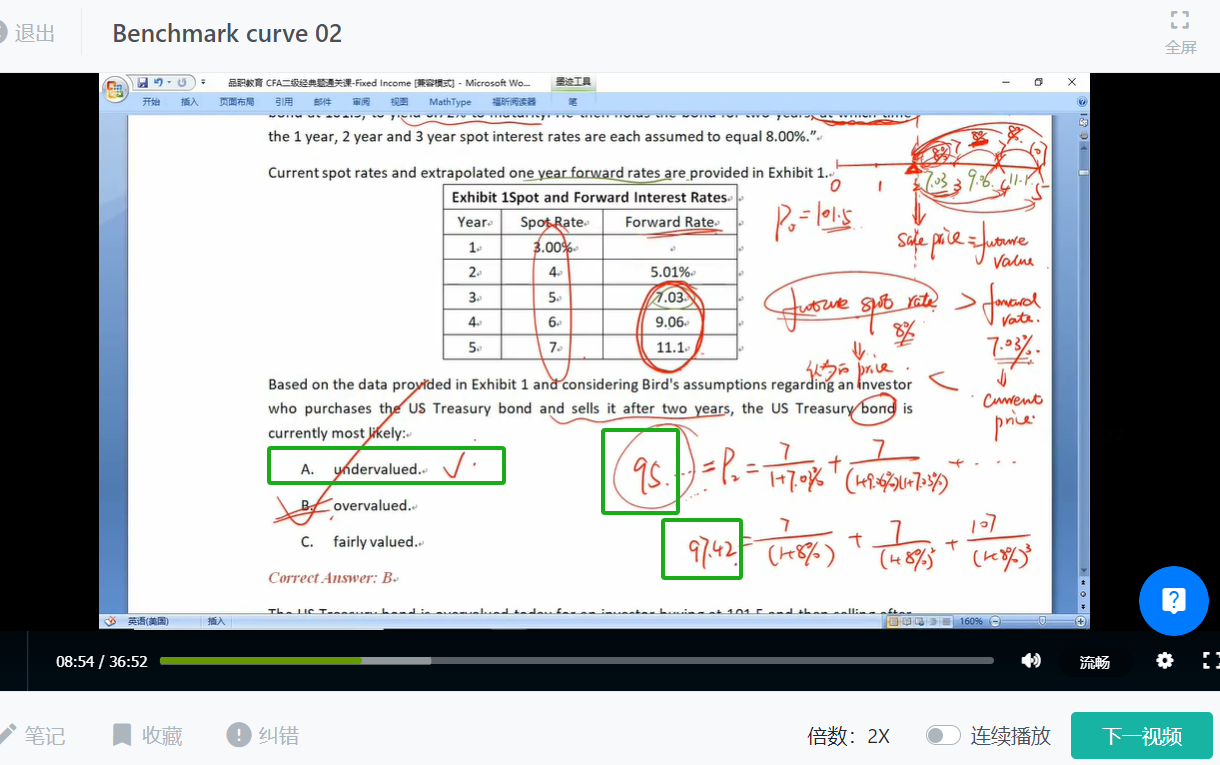

Current spot rates and extrapolated one year forward rates are provided in Exhibit 1.

Based on the data provided in Exhibit 1 and considering Bird's assumptions regarding an investor who purchases the US Treasury bond and sells it after two years, the US Treasury bond is currently most likely:

选项:

A.undervalued.

overvalued.

fairly valued.

解释:

Correct Answer: B

The US Treasury bond is overvalued today for an investor buying at 101.5 and then selling after two years given the forward curve in Exhibit 1 and Bird’s assumptions. For any bond in which the expected future spot rates (8.00% for each of the remaining three years of the bonds term) is higher than a quoted forward rate for the same maturity (7.03%, 3 year forward rate implied by the current spot curve), the bond is overvalued vs. its intrinsic value since the market is placing a lower discount rate on its cash flows (7.03% forward rate today vs. 8.00% assumed future spot rate). Presuming that the forward curve shifts higher as anticipated by Bird, the fair value of the bond is $97.42. Since the rates did not materialize as anticipated by the original forward curve but rather rose, the price of the bond falls relative to the original estimates, and, therefore was overvalued. The total return over the two year horizon is -1.86%.

如题