NO.PZ2023040501000102

问题如下:

Paulinic investigates R-bank’s risk management practices with respect to the use of credit derivatives to enhance earnings, following the 2008 financial crisis. Exhibit 4 displays R-bank’s exposure over the last decade to credit derivatives not classified as hedges.

Based only on Exhibit 4, R-bank’s use of credit derivatives since 2007 most likely: (curriculum)

选项:

A.increased posted collateral.

decreased the volatility of earnings from trading activities.

indicates consistent correlations among the relevant risks taken.

解释:

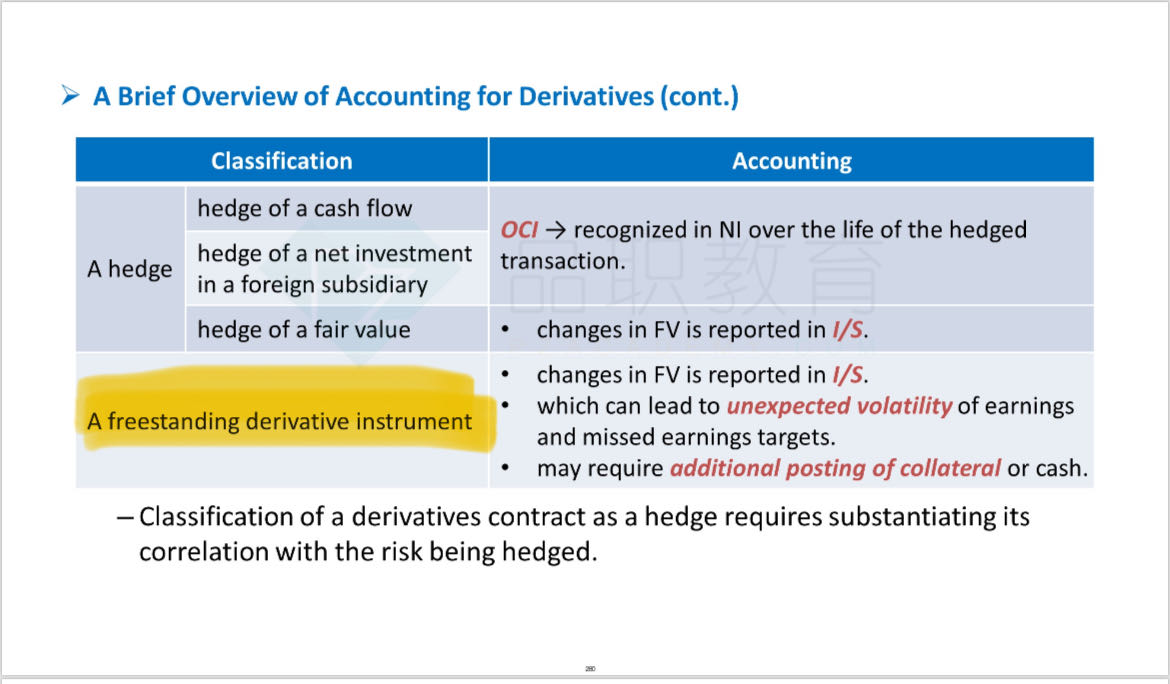

Exhibit 4 indicates that exposure to free-standing credit derivatives dramatically declined from a peak during the global financial crisis in 2008. If a derivatives contract is classified as freestanding, changes in its fair value are reported as income or expense in the income statement at each reporting period. The immediate recognition of a gain or loss in earnings, instead of reporting it in other comprehensive income, can lead to unexpected volatility of earnings and missed earnings targets. As a result, earnings volatility from the use of credit derivatives most likely decreased.

可以再解釋這道題嗎?A爲什麽不對?