NO.PZ2023010903000070

问题如下:

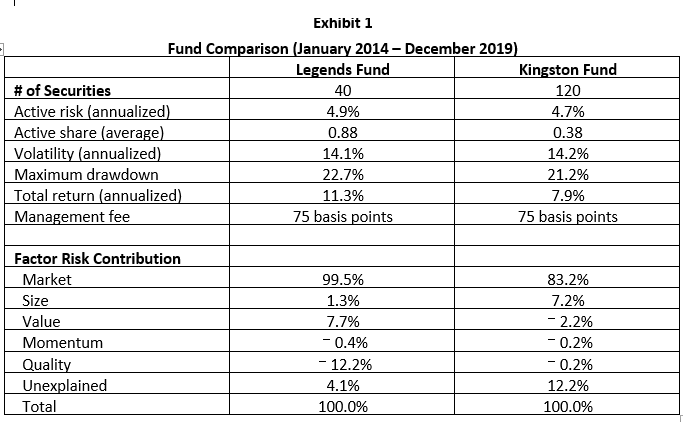

After answering a few additional questions, Swanson provides Rizzitano with a one-page document comparing the Legends Fund to the Kingston Fund. The information in this document is displayed in Exhibit 1. Swanson notes that the Kingston Fund is the Legends Fund's closest competitor and employs a very similar investment philosophy focused on quality. Swanson tells Rizzitano that the document demonstrates that the Legends Fund has a much more efficient portfolio structure than the Kingston Fund.

Identify two fund characteristics in Exhibit 1 that support Swanson's comment regarding the Legends Fund's relatively efficient portfolio structure.

选项:

解释:

Answer:

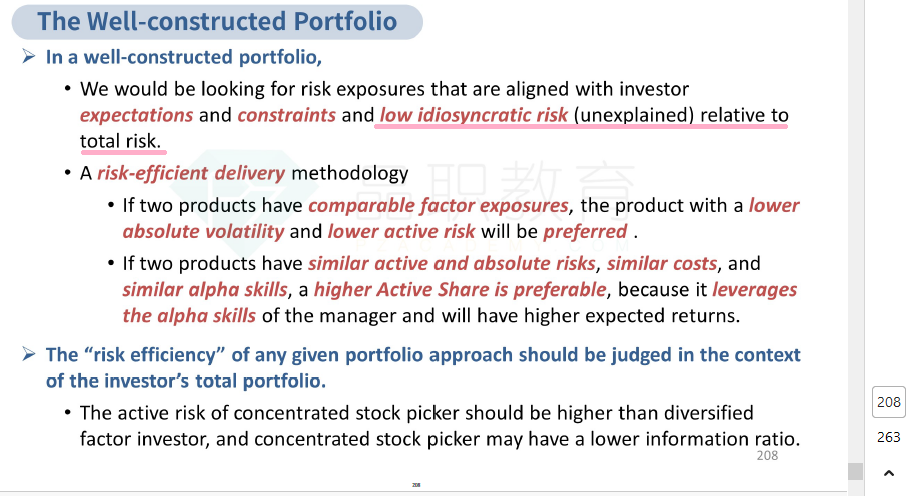

An efficient, well-constructed portfolio should have 1) risk exposures that align with investor expectations, and 2) low idiosyncratic(unexplained) risk relative to total risk.

The investment philosophies of both the Legends Fund and the Kingston Fund focus on the quality risk factor. However, the factor risk contributions provided in Exhibit 1 suggest that quality is a significant factor exposure for the Legends Fund at-12.2% but is insignificant for the Kingston Fund at -0.2%. This supports Swanson's statement.

In addition, the amount of idiosyncratic risk is much higher as a percentage of total risk for the Kingston Fund, at 12.2%, versus just 4.2% for the Legends Fund. This also supports Swanson's statement.

第一个问题

如题,想从risk and structual characteristics as promised 以及 A risk-efficient delivery methodology的角度答题。

首先描述quality factor的contribution更大,因此满足第一条risk and structual characteristics as promised。

另外就是Active share / active risk更大,因此满足A risk-efficient delivery methodology。

第二个问题

我看解析都没提 risk-efficient delivery methodology,反而提了unexplained return?请问讲义里关于Risk efficient的定义中的4条,哪里看出了需要unexplained return?