NO.PZ2023032701000047

问题如下:

The management of Telluride, an international diversified conglomerate based in the United States, believes that the recent strong performance of its wholly owned medical supply subsidiary, Sundanci, has gone unnoticed. To realize Sundanci’s full value, Telluride has announced that it will divest Sundanci in a tax-free spin-off.

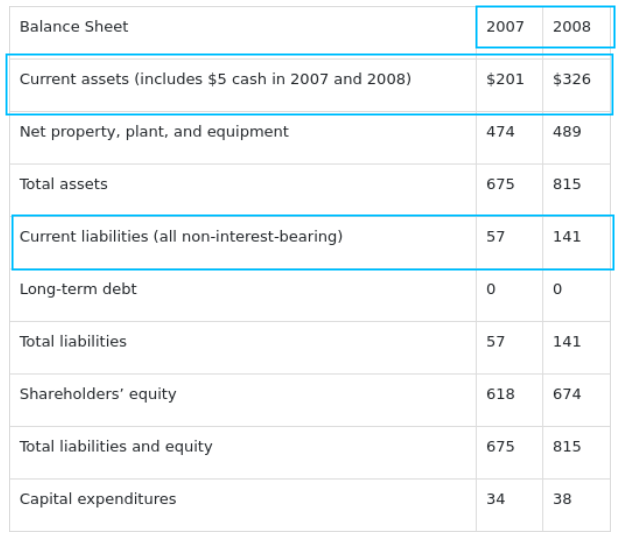

Sue Carroll, CFA, is director of research at Kesson and Associates. In developing an investment recommendation for Sundanci, Carroll has gathered the information shown in Exhibits 1 and 2.

Exhibit 1.Sundanci Actual 2007 and 2008 Financial Statements for Fiscal Years Ending 31 May (Dollars in Millions except Per-Share Data)

Exhibit 2.Selected Financial Information

Abbey Naylor, CFA, has been directed by Carroll to determine the value of Sundanci’s stock by using the FCFE model. Naylor believes that Sundanci’s FCFE will grow at 27 percent for two years and at 13 percent thereafter. Capital expenditures, depreciation, and working capital are all expected to increase proportionately with FCFE.

The current value of a share of Sundanci stock based on the two-stage FCFE model is:

选项:

A.$40.7859

$41.7859

$40.4673

解释:

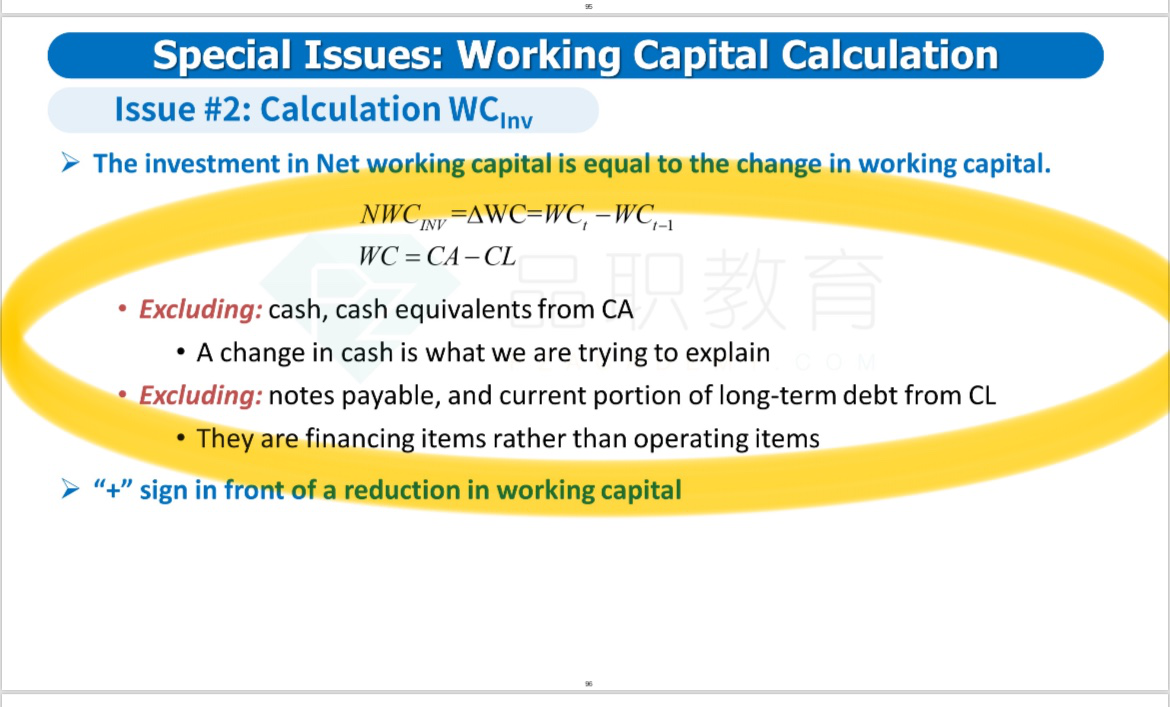

Calculate the amount of FCFE per share for 2008 by using the data from Exhibit 1.

FCFE is defined as the cash flow remaining after the company meets all financial obligations, including debt payment, and covers all capital expenditure and working capital needs. Sundanci’s FCFE for the year 2008 is calculated as follows:

Thus, FCFE per share equals ($24 million)/(84 million shares) = $0.286.

The FCFE model requires forecasts of FCFE for the high-growth years (2009 and 2010) plus a forecast for the first year of stable growth (2011) to allow for an estimate of the terminal value in 2010 based on constant perpetual growth. Because all of the components of FCFE are expected to grow at the same rate, the values can be obtained by projecting the FCFE at the common rate. (Alternatively, the components of FCFE can be projected and aggregated for each year.)

The following table provides the process for estimating Sundanci’s current value on a per-share basis.

如题