NO.PZ2023120801000042

问题如下:

By using matrix pricing, investors can estimate market discount rates and prices for bonds:

选项:

A.

with different coupon rates.

B.

that are not actively traded.

C.

with different credit quality.

解释:

Correct Answer: B

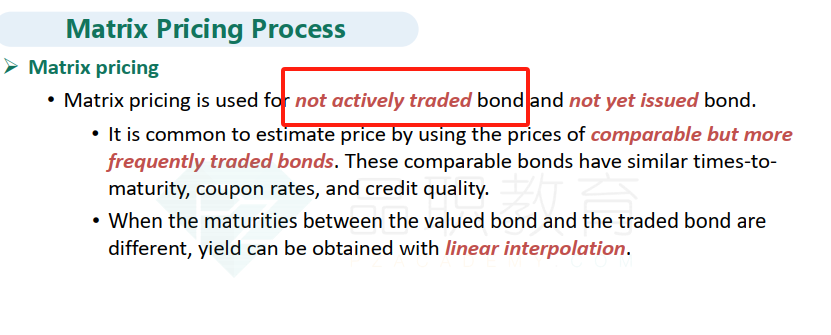

For bonds not actively traded or not yet issued, matrix pricing is a price estimation process that uses market discount rates based on the quoted prices of similar bonds (similar times-to-maturity, coupon rates, and credit quality).

请问matrix pricing是怎么操作的?解析没有看明白