NO.PZ202304050100001101

问题如下:

(1) If Eagle uses the equity method, the income ($ millions) from its investment in Aurora for 2012 will be closest to:

选项:

A.16.2.

17.4.

21.0.

解释:

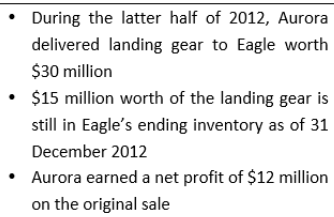

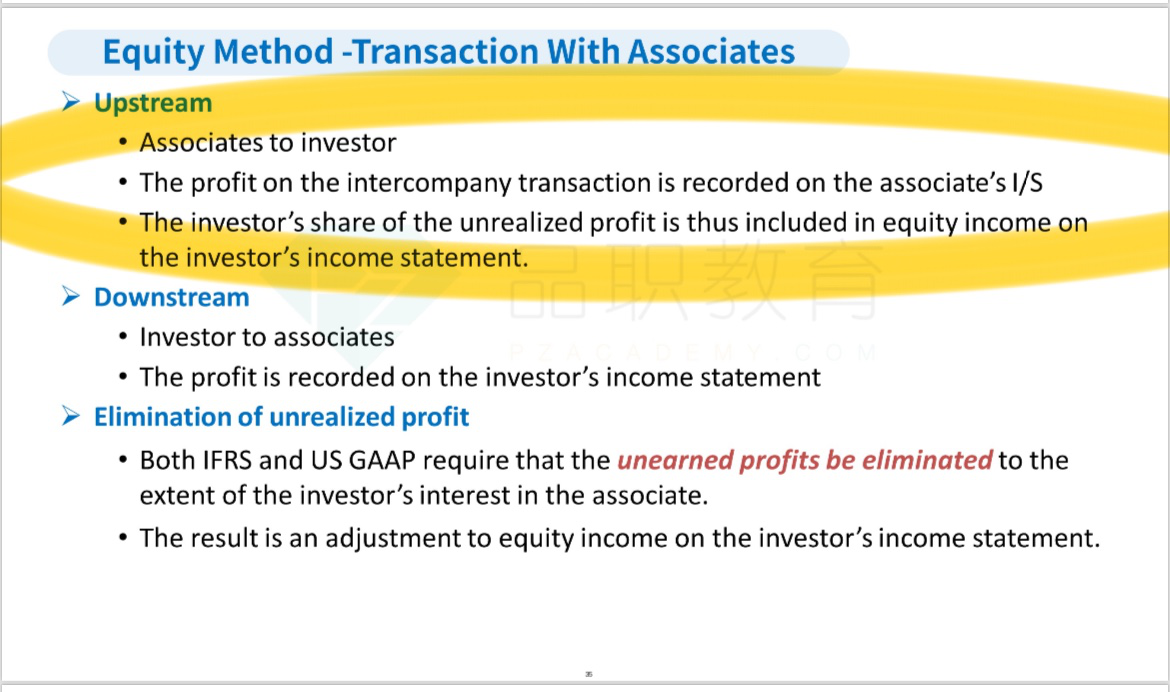

From the initial acquisition, Eagle’s share of the unrecorded identifiable intangible assets is $60 million × 20% = $12 million. This amount will have to be amortized against investment income over its useful life of 10 years (12/10 = 1.2 per year).

可以详细讲解下逻辑和过程吗?