NO.PZ2023100905000005

问题如下:

You are a manager of a renowned hedge fund and are analyzing a 1,000-share position in an undervalued but illiquid stock BNA, which has a current stock price of USD 80 (expressed as the midpoint of the current bid-ask spread). Daily return for BNA has an estimated volatility of 1.54%. The average bid-ask spread is USD 0.10. Assuming returns of BNA are normally distributed, what is the estimated liquidity-adjusted daily 95% VaR, using the constant spread approach?

选项:

A.

USD 1,389

B.

USD 2,076

C.

USD 3,324

D.

USD 4,351

解释:

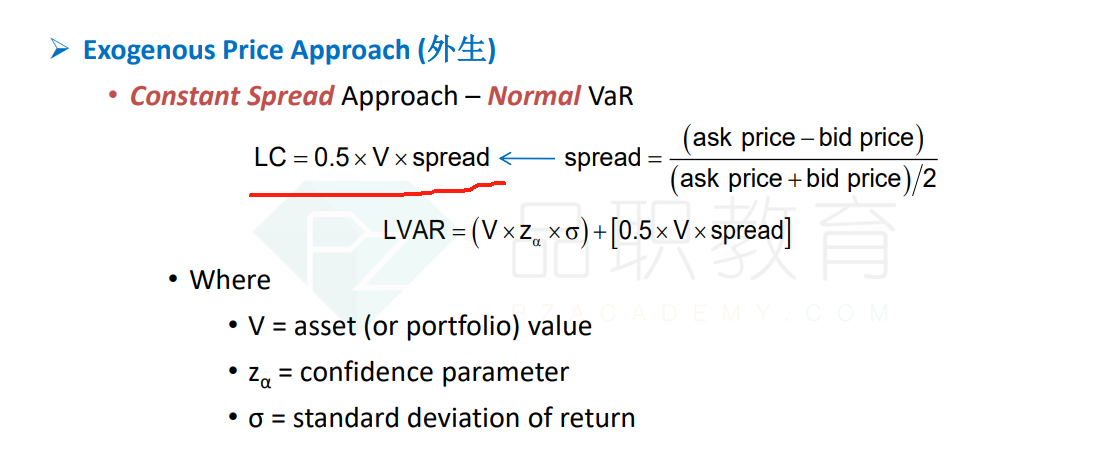

The constant spread

approach adds half of the bid-ask spread (as a percent) to the VaR calculation:

Daily 95% VaR = 80,000

(1.645 × 0.0154) = USD 2026.64

Liquidity cost (LC) =

80,000 × (0.5 × 0.10/80) = 50

LVaR = VaR + LC =

2076.64

在计算lvar时,怎么区分使用哪个公式进行计算