NO.PZ2023102101000001

问题如下:

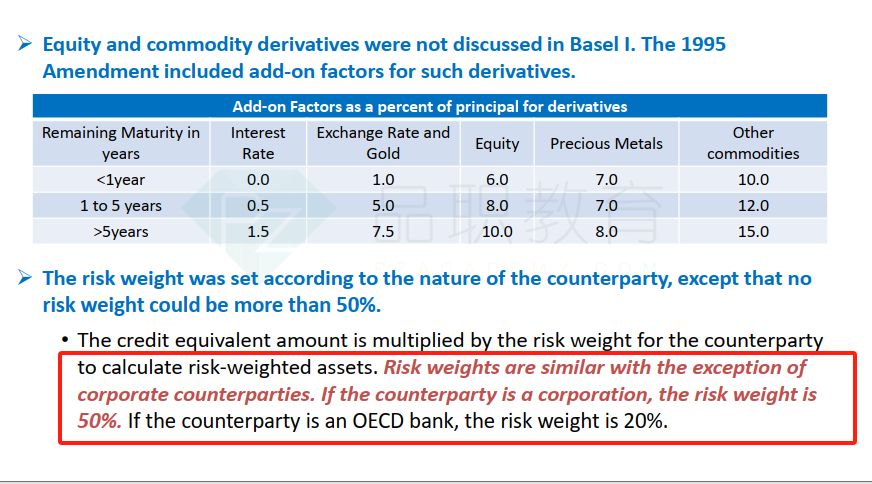

Michigan One Bank and Trust has entered a $200 million interest rate

swap with a corporation. The remaining maturity of the swap is six years. The

current value of the swap is -$3.5 million. Using the table below to find the

add-on factor for the interest rate swap, the equivalent risk-weighted assets

(RWA) under Current Exposure Method Basel I is closest to:

选项:

A.$3,000,000

$1,500,000

$3,500,000

$6,500,000

解释:

The add-on factor is 1.5% of the interest

rate swap principal for swaps with a maturity greater than five years.

Credit equivalent amount = max (V, 0) + D=

max (V, 0) + add-on factor × NP

Credit equivalent amount = 0+(0.015 × $200,000,000)

= $3,000,000

The risk-weight factor for a corporate

counterparty under Basel I is 50% for derivatives and 100% for

corporate loans. This means the risk-weighted assets (RWA) are:

RWA = 0.50 × $3,000,000 = $1, 500,000

The risk-weight factor for a corporate counterparty under Basel I is 50% for derivatives这个没找到啊