NO.PZ201803130100000107

问题如下:

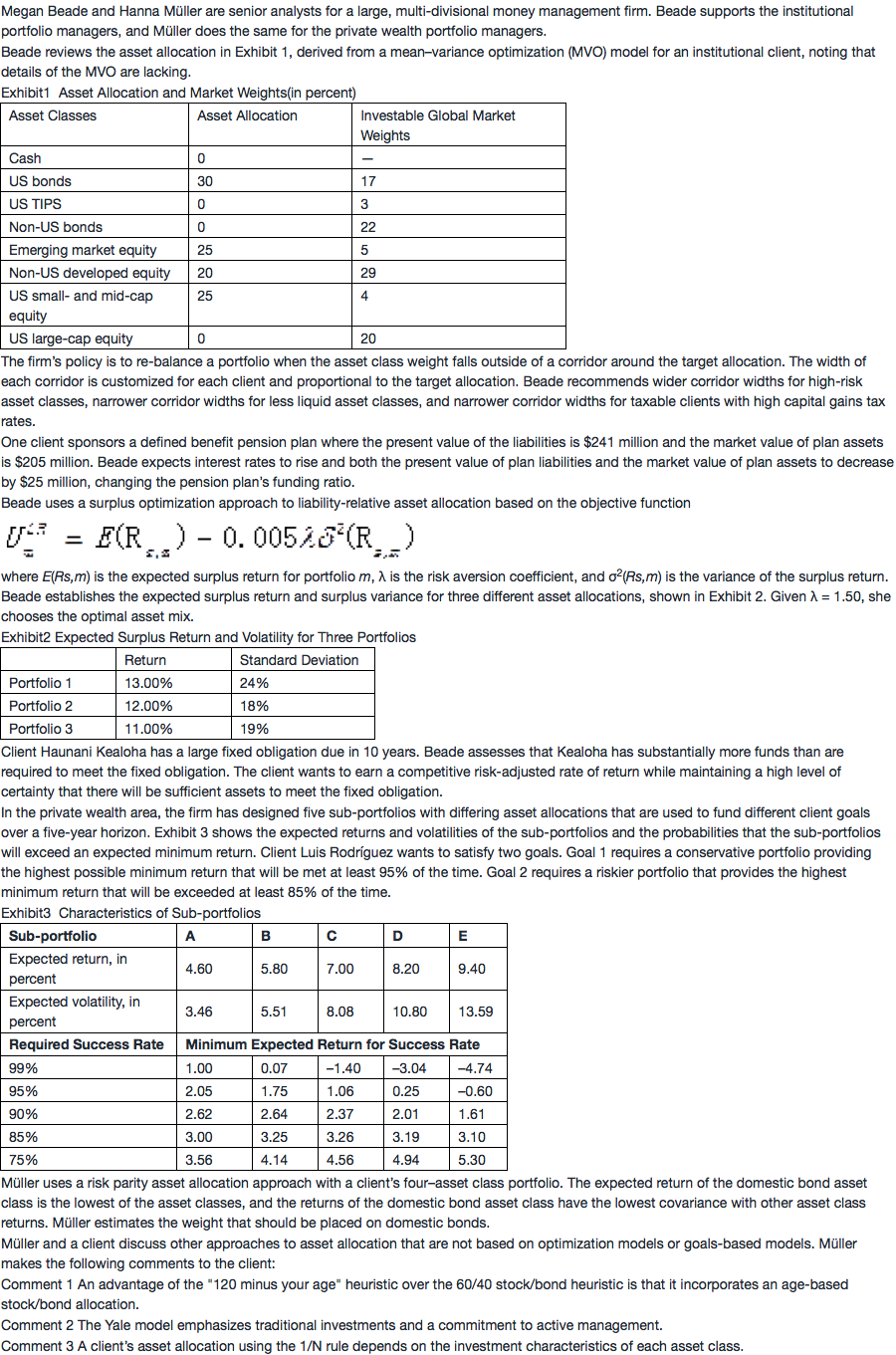

In the risk parity asset allocation approach that Müller uses, the weight that Müller places on domestic bonds should be:

选项:

A.less than 25%.

B.equal to 25%.

C.greater than 25%.

解释:

C is correct.

A risk parity asset allocation is based on the notion that each asset class should contribute equally to the total risk of the portfolio. Bonds have the lowest risk level and must contribute 25% of the portfolio’s total risk, so bonds must be overweighted (greater than 25%). The equal contribution of each asset class is calculated as:

wi* Cov(ri,rp)=

where

wi = weight of asset i

Cov(ri,rp) = covariance of asset i with the portfolio

n = number of assets

σ2= variance of the portfolio

In this example, there are four asset classes, and the variance of the total portfolio is assumed to be 25%; therefore, using a risk parity approach, the allocation to each asset class is expected to contribute (1/4 × 25%) = 6.25% of the total variance. Because bonds have the lowest covariance, they must have a higher relative weight to achieve the same contribution to risk as the other asset classes.

- 为什么 variance of total portfolio = 25%?

- 1/n * portfolio variance = w * covariance, 1/n * portfolio variance = actr, 那么 w * covariance = actr 么?如果是的话, 应该怎么理解这个公式呢?